Post Office Monthly Income Scheme 2022 is a best five year investment with maximum ceiling of Rs. 4.5 lakh under single ownership and Rs. 9 lakh under joint ownership. Central government now fixes interest rate at 6.6% per annum (w.e.f 1 January 2022) payable monthly. Subscribers can calculate their interest earned through MIS calculator and also see bonus amount after every month. All those candidates who wants to earn regular income every month can make investment.

PO-MIS investment does not qualify for any tax benefit under s/c 80 C and interest earned is fully taxable. Account may be closed on expiry of 5 years from the date of opening by submitting prescribed application form with pass book at concerned Post Office. In case the account holder dies before the maturity, the account may be closed and amount will be refunded to nominee/legal heirs. Interest will be paid up to the preceding month, in which refund is made.

This type of investment keeps your amount intact, provide better guaranteed returns along with ensuring fixed monthly income. Interested candidates can download the MIS Application Form and open their mis savings account. People can Compare All Post Office Schemes before making investment.

Post Office Monthly Income Scheme Calculator / Interest Rate

Monthly Income Scheme Offers an annual interest rate of 6.6% p.a. So, an amount of 1,00,000 deposited in mis account yields a monthly payout of Rs. 550 every month. People can see PO Monthly Income Scheme Calculator to calculate their regular monthly income.

- Interest shall be payable on completion of a month from the date of opening and so on till maturity.

- If the interest payable every month is not claimed by the account holder such interest shall not earn any additional interest.

- In case any excess deposit made by the depositor, the excess deposit will be refunded back and only PO Savings Account interest will be applicable from the date of opening of account to the date of refund.

- Interest can be drawn through auto credit into savings account standing at same post office, or ECS. In case of MIS account at CBS Post offices, monthly interest can be credited into savings account standing at any CBS Post Offices.

- Interest is taxable in the hand of depositor.

Just click this link and enter the values in the un-shaded cells under POMIS Calculator section. Then the candidates will get all the details about monthly income, premature withdrawal amount at different intervals, bonus and principal amount at maturity.

Post Office Savings Monthly Income Scheme (MIS) Account Details

Either of the parents can open this best monthly income scheme account in the name of minor below 10 years of age. The important features of this PO monthly income scheme are as follows:-

- Post Office Monthly Income Scheme provides assured return of mis interest rate 2022 of 6.6% per annum.

- This type of investment is absolutely risk free. Subscribers also get the facility of nomination.

- People can earn fixed monthly payouts directly into their account. Auto Credit facility directly into the post office savings account is also available at any CBS Post Office.

- All the account holders open Recurring Deposit (RD) Account and deposit the interest earned in RD along with this scheme to grow their invested amount.

- Even minors are also applicable to invest in this scheme. After 10 years, they can apply for account conversion in their own name and then can individually operate their account.

People can withdraw money directly from PO or can get credited in their savings account through ECS. People must withdraw their interest on monthly basis. If not so, then the interest earned will not yield any further profit, it sits idle.

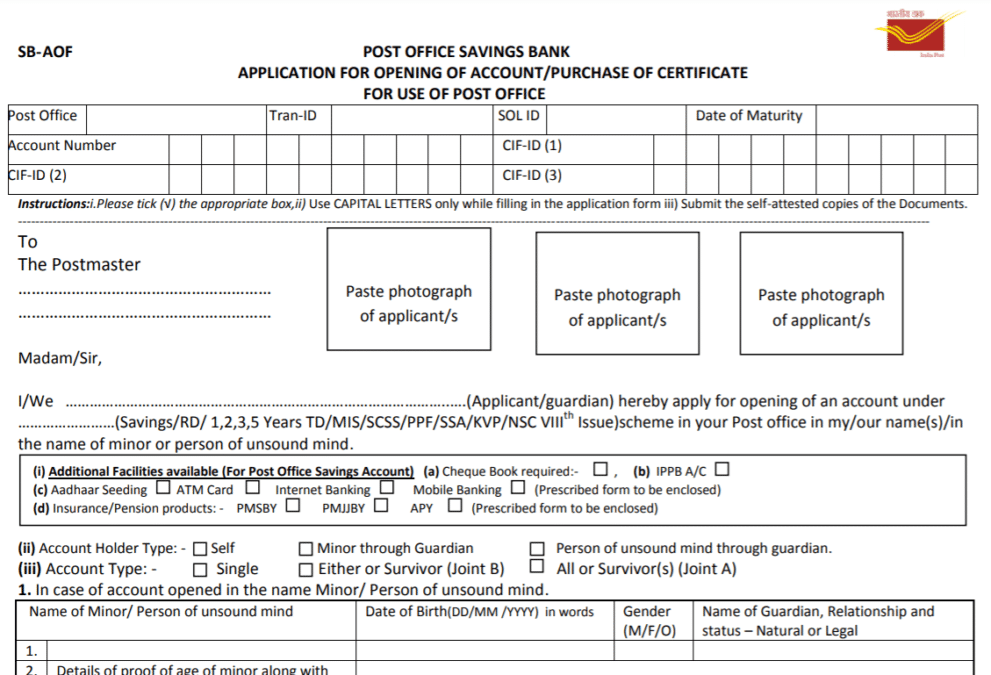

Post Office MIS Account Opening Form 2022

All those who want to open mis account can download the Post Office Monthly Income Scheme account opening application form – MIS Account Opening Form

The Post Office Monthly Income Scheme Account Opening Form will appear as shown below:-

Direct Link – https://www.indiapost.gov.in/VAS/Pages/Form.aspx#SavingBank

Who can open Monthly Income Scheme Account

(i) a single adult

(ii) Joint Account (up to 3 adults) (Joint A or Joint B))

(iii) a guardian on behalf of minor/ person of unsound mind

(iv) a minor above 10 years in his own name.

Post Office Monthly Income Scheme Deposits

The minimum amount that any individual must deposit is Rs. 1000 and in its multiples of Rs. 100 thereafter. Minors can invest a maximum amount of Rs. 4,50,000. The maximum amount that any individual can invest is Rs. 4,50,000 in single account. For joint account this limit is Rs. 9 lakh. Moreover in joint account also, the maximum share of any person can be Rs. 4,50,000. All joint account holders shares equal share in mis savings account. In a joint account, all the joint holders shall have equal share in investment.

Deposits/shares in all MIS accounts opened by an individual shall not exceed Rs. 4.50 lakh. Limit for account opened on behalf of a minor as guardian shall be separate. This is the best monthly income scheme of post offices without any risk factor involved.

Post Office Monthly Income Scheme Premature Withdrawal

However, people can opt for premature withdrawal before completing 5 years which is subject to the following conditions.

- No deposit shall be withdrawn before the expiry of 1 year from the date of deposit.

- If account is closed after 1 year and before 3 year from the date of account opening, a deduction equal to 2% from the principal will be deducted and remaining amount will be paid.

- If account closed after 3 year and before 5 year from the date of account opening, a deduction equal to 1% from the principal will be deducted and remaining amount will be paid.

- Account can be prematurely closed by submitting prescribed application form with pass book at concerned Post Office.

MIS scheme has a lock-in period of 5 years (w.e.f 1 December 2011). All the subscribers will get fixed monthly income in this duration.

POMIS Eligibility Criteria

The candidates must fulfill the following eligibility criteria to invest in this scheme:-

- Candidates must be an Indian Resident. POMIS does not allow NRIs to make investment.

- Minimum age requirement is 10 years. Any individual of more than 10 years of age can open this MIS savings account in their name and operate it.

- For individuals below 10 years of age (minors), parents can open an account in their name.

Any individual can open any number of mis accounts in post offices. However the maximum limit after adding balances in different accounts still remains the same.

MIS Nomination Facility

All the eligible subscribers can open multiple accounts in any post office as well as joint mis accounts. Any individual can open this type of account in name of a minor below 10 years or for themselves. Nomination Facility is available at the time of account opening and even after opening mis account. People can select a nominee at any time they wish before maturity.

MIS savings account facilitate subscriber to operate more than 1 accounts in individual capacity or jointly. After 10 years, minor must convert MIS account in his name. The maximum limit on the deposits made by an individual still holds. People can convert their single account to joint account and vice versa.

Post Office Monthly Income Scheme 2022 Highlights

The important features and highlights of mis savings scheme are as follows:-

- Any individual can open an mis account. MIS Account opening procedure involves payment through cash / cheque

- MIS Account holders can avail the facility of nomination at the time of opening and also after opening the account..

- Subscribers can transfer their account from 1 post office to another.

- Any individual can open any number of accounts in any post office. However, the maximum investment must not be greater than Rs. 4.5 lakh.

- Parents can open Monthly Income Scheme Account in the name of a minor below 10 years of age. Minors above 10 years of age can open an account in their own name and operate it also.

- 2 or 3 individuals can also open a joint account.

- Each account holder must have an equal share.

- Any person can convert their single account to joint account and vice versa.

- Minor must apply for conversion of account in his own name after attaining 10 years of age.

- MIS Account Maturity Period / Inter Locking Period is 5 years.

- People can make interest withdrawal into their savings account at same post office through PDCs / ECs. For CBS Post Offices, people can get interest auto credited in savings account at any CBS Post office.

- People can withdraw their principal amount between 1 year to 3 years with 2% deduction / discount and between 3 to 5 years with 1% deduction. After 5 years (maturity) subscribers can withdraw their entire money.

- Principal Amount in MIS is completely secure. No TDS is applicable under s/c 80C. However the interest earned is entirely taxable.

For more details about the scheme, please visit the official website indiapost.gov.in

References

— To download application form in pdf format of all post office savings scheme, please click the link:-

Post Office Schemes Application Form Download

— For more details, visit the official website at https://www.indiapost.gov.in/Financial/Pages/Content/Post-Office-Saving-Schemes.aspx

from सरकारी योजना

via

0 टिप्पणियाँ