Odisha govt loan scheme | dhe Odisha | Odisha government loan amount | sams Odisha | Odisha govt. loan from world bank | Odisha loan | study loan in Odisha gramya bank | how to apply for kssy loan. The Odisha state government has launched Kalinga Sikhya Sathi Yojana (KSSY) to provide education loan for those student who are pursuing higher studies. In this article, we will tell you about Odisha Kalinga Sikhya Sathi Yojana (KSSY) education loan online application form 2021 at vidyalakshmi.co.in, how to make registration / login at vidya lakshmi portal, check list of banks to apply offline, required documents, CSIS vs KSSY comparison, moratorium period, objectives, benefits, latest updates.

Under Kalinga Sikhya Sathi Yojana, students would be provided education loan at an interest rate of just 1% by the several banks.

What is Odisha Kalinga Sikhya Sathi Yojana 2021

The Odisha Government has come up with a new scheme named as Kalinga Sikhya Sathi Yojana (KSSY) for the aspiring students at only 1% interest. It has been launched by Hon’ble CM of Odisha, Shri Naveen Patnaik on 27th June 2016. This scheme has been launched to bring down the financial burden on the parents of the students who want to move forward with higher education.

The objective of Kalinga Sikhya Sathi Yojana (KSSY) is to reduce the burden of parents who can not afford to fee for higher studies. Moreover, this scheme will provide loan up to Rs. 10 lakh at 1% of interest rate to the students. The intention behind this scheme is to motivate the poor students to complete the higher studies.

Odisha Kalinga Sikhya Sathi Yojana Latest Update

Odisha Kalinga Sikhya Sathi Yojana scheme is applicable to students availing education loan from scheduled banks upto Rs. 10 lakh. The KSSY scheme will apply to all courses being pursued in all educational institutions for which the Govt. of India interest subvention is applicable as per the CSIS scheme to provide interest subsidy. In case of loans upto Rs. 10 lakhs, the repayment period shall not exceed 15 years including the moratorium period.

Financial assistance shall be provided in the form of interest subvention at such a rate that the net interest payable by the student after the moratorium period becomes 1% per annum. The selection of beneficiaries and documentation including security against the loan will be as per terms of the respective bank. The modification is applicable in respect of fresh education loans sanctioned on or after 1 April 2016 under the scheme.

Details about the scheme Kalinga Sikhya Sathi Yojana

A student can avail loan under the scheme “Kalinga Sikya Sathi Yojana” from scheduled banks for pursuing higher studies. The scheme will give them up to 10 lakh rupees to proceed for the higher courses.

- Maximum Loan: According to the rules of the scheme, a student can get maximum of 10 lakh rupees as an educational loan under this scheme.

- Minimum Loan: There is no minimum loan amount mentioned in the scheme. One can get any amount of loan up to Rs. 10 lakh.

- Period of Loan: The period of repayment will be up to 10 years and 15 years in respect of loan sanctioned up to 7.5 lakhs and 10.00 lakhs respectively.

- Rate of Interest: The applicants will have to pay only 1% interest on the loan amount. The balance amount of the interest will be borne by Government of Odisha, Higher Education Department.

Eligibility Criteria for Odisha Kalinga Sikhya Sathi Yojana

- The student must be a resident of Odisha.

- As per the eligibility criteria, the annual income of the family of the applicant up to 6 lakhs per annum. The terms are conditions of loan will be as per norms of individual schedule banks. The loan applications will be processed by the rules of the banks. The poor students who are willing to continue higher studies can apply for the loan under this scheme.

List of Documents Required to Get Education Loan under KSSY

- All Educational Certificates, including the document indicating admission into a technical / professional course

- Residential Certificate issued not only the below rank of Tahasildar and Additional Tahasildar.

- Income Certificate issued not only the below rank of Tahasildar and Additional Tahasildar or Self certified copy of IT return

Moratorium Period of Loans in KSSY Scheme

Generally, the moratorium period of education loans is course period plus one year depending on the banks. But under KSSY, the financial assistance in the form of interest subvention shall be provided for the period of repayments including moratorium period after the completion of course. This will prove to be very beneficial to students.

Comparison between CSIS and KSSY

CENTRAL SCHEME FOR INTEREST SUBSIDY (without dovetailing of KSSY) and KALINGA SIKHYA SATHI YOJANA (with dovetailing of CSIS)

| Sl# | FEATURE | CENTRAL SCHEME FOR INTEREST SUBSIDY (without dovetailing of KSSY) | KALINGA SIKHYA SATHI YOJANA (with dovetailing of CSIS) |

|---|---|---|---|

| 1 | COURSES | Professional courses in UGC/AICTE recognised Institutions | Same as in CSIS |

| 2 | ELIGIBILITY | Upto annual income of Rs 4.5 lakh | Upto annual income of Rs 6 lakh |

| 3 | REPAYMENT PERIOD | UPTO 15 YEARS EXCLUDING MORATORIUM PERIOD | i) FOR LOANS UPTO RS. 7.5 LAKH, 10 YEARS ( INCLUSIVE OF MORATORIUM PERIOD) ii) For loans upto Rs 10 lakh, 15 years ( inclusive of moratorium period) |

| 4 | INTEREST RATE | ZERO during the moratorium period, followed by CARD rate of interest for 15 years. | ZERO during the moratorium period , followed by 1 % per year for five years |

| 5 | TYPICAL CACULATION OF REPAYMENT LIABILITY PER RS.1 LAKH LOAN uptoRs 7.5 lakh | EMI for 60 months = 0 EMI FOR NEXT 180 months @ Rs.1,075 TOTAL INTEREST AND PRINCIPAL LIABILITY FOR THE STUDENT: Rs 1,93,429 (in respect of each Rs 1 lakh borrowed) (EMI is calculated by taking interest rate as 10% . It may vary as per interest rate). |

EMI FOR 60 MONTHS = 0 * EMI FOR NEXT 60 MONTHS @ RS. 1,709 TOTAL INTEREST AND PRINCIPAL LIABILITY FOR THE STUDENT: Rs. 1,02,562 (in respect of each Rs 1 lakh borrowed) (EMI is calculated by taking interest rate as 10% . It may vary as per interest rate). Saving to student for each Rs.1 lakh loan= Rs. 90,867/- |

| 6 | TYPICAL CALCULATION OF REPAYMENT LIABILITY FOR LOAN OF RS TEN LAKH | EMI FOR 60 MONTHS = 0 EMI FOR NEXT 180 MONTHS @ Rs. 10,750 TOTAL LIABILITY FOR STUDENT: Rs. 19,34,290 (EMI is calculated by taking interest as 10.75% . It may vary as per interest rate). |

EMI FOR 60 MONTHS = 0 EMI FOR NEXT 120 MONTHS @ Rs. 8,760 TOTAL LIABILITY FOR STUDENT: Rs. 10,51,249 (EMI is calculated by taking interest rate as 10.75% . It may vary as per interest rate). Saving to student for a Rs.10 lakh loan = Rs. 8,83,041/- |

- Under KSSY, for family income upto Rs. 4.5 lakh, interest subsidy during moratorium period is met from GOI as per CSIS, while the interest subvention beyond the period is met fully by the Govt. of Odisha.

- Under KSSY, for family income between Rs. 4.5 lakhs to Rs. 6 lakhs, the interest subsidy for the entire period of loan is met fully by the Govt. of Odisha.

- Saving to student for each Rs. 1 lakh loan (upto loan of Rs. 7.5 lakhs) = Rs. 90,867/- + Interest cost during the period of moratorium.

- Saving to student for Rs. 10.00 lakh loan (for loans from 7.5 lakhs to 10.00 lakhs) = Rs. 8,83,041/- + Interest cost during the period of moratorium.

Benefits of Odisha Kalinga Sikhya Sathi Yojana

If you are a student of any professional course and have availed benefit of education loan from any Bank after 01-April-2016, please note that you are entitled to get the loan to be converted to “Kalinga Sikhya Sathi Yojana”.

The advantages will be:

- You can get the interest rate that will apply after the moratorium period reduced to 1%.

- Your interest repayment terms will accordingly change so that the total repayment period of the loan will reduce, after completion of your course.

You are therefore advised to avail these benefits, by contacting the concerned Branch Manager immediately.

Application Forms of Kalinga Sikhya Sathi Yojana (KSSY)

Interested and eligible students can apply for Sikhya Sathi Yojana through both offline and online modes to get education loan. The offline applications can be made by visiting any of the following bank branches.

List of Banks for Offline KSSY Education Loan

| S. No. | Bank Name |

|---|---|

| 1 | Allahabad bank |

| 2 | Andra Bank |

| 3 | Bank of Baroda |

| 4 | Bank of India |

| 5 | Bank of Maharastra |

| 6 | Bharatiya Mahila Bank |

| 7 | Canara Bank |

| 8 | Central Bank |

| 9 | Central Bank of India |

| 10 | Dena Bank |

| 11 | IDBI Bank |

| 12 | India Bank |

| 13 | India Overseas Bank |

| 14 | Oriental Bank of Commerce |

| 15 | Punjab & Sind Bank |

| 16 | Punjab National Bank |

| 17 | State Bank of Bikaner & Jaipur |

| 18 | State Bank of Hyderabad |

| 19 | State Bank of India |

| 20 | State bank of Mysore |

| 21 | State Bank of Travancore |

| 22 | Syndicate Bank |

| 23 | UCO Bank |

| 24 | Union Bank of India |

| 25 | United Bank of India |

| 26 | Vijaya Bank |

| 27 | Axis Bank Ltd |

| 28 | Bandhan Bank |

| 29 | City Union Bank |

| 30 | DCB |

| 31 | Federal Bank |

| 32 | HDFC Bank |

| 33 | ICICI Bank |

| 34 | Indus Ind Bank |

| 35 | Karnatak Bank |

| 36 | Karur vysya Bank |

| 37 | Kotak Mahindra Bank |

| 38 | laxmi Vilas Bank |

| 39 | Standard Chartered Bank |

| 40 | the South Indian Bank Ltd |

| 41 | Yes Bank |

| 42 | Orissa State Co-op. Bank |

The sample application form of KSSY education loan scheme can be downloaded from the below link

Sample Application Form Download.

Apply Online for KSSY at vidyalakshmi.co.in

Below is the step by step online application procedure for Kalinga Sikhya Sathi Yojana (KSSY) education loan scheme

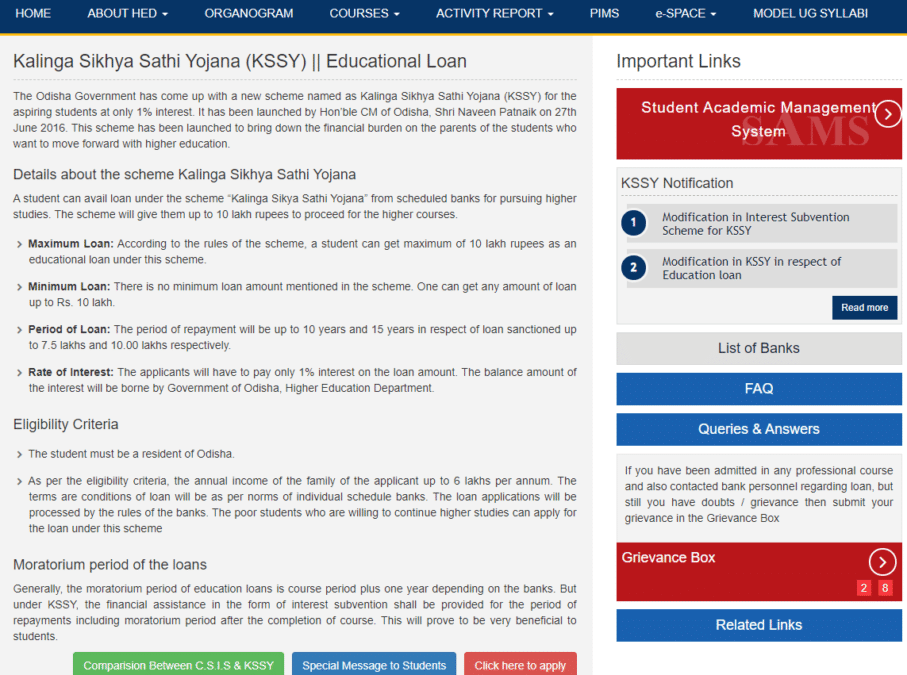

STEP 1: Visit the official website at http://dheodisha.gov.in/KSSY/KSSY.aspx

STEP 2: After reaching on website, you will see “Kalinga Sikhya Sathi Yojana (KSSY) || Education Loan” section.

STEP 3: At this page, all the guidelines and online application link is provided. Read all the scheme guidelines and online application form instructions and click on “Click here to apply” button at the bottom of the page.

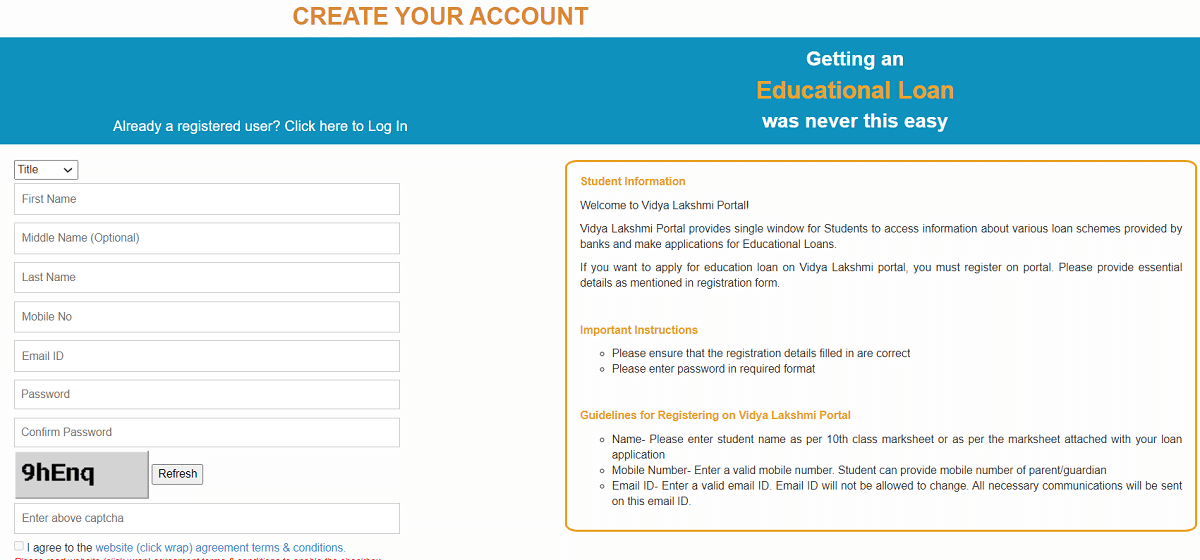

STEP 4: A new Vidya Lakshmi portal which can be accessed through the link https://www.vidyalakshmi.co.in/Students/ will be opened.

STEP 5: At this portal click the “Register” link or directly click https://www.vidyalakshmi.co.in/Students/signup to fill the registration form for education loan. Enter all the required details in the appeared form.

STEP 6: After filling all the details, click on terms and conditions link because without click on terms and condition link candidate will not be able to complete the form.

STEP 7: Then click on “Submit” button and the candidate will be registered successfully.

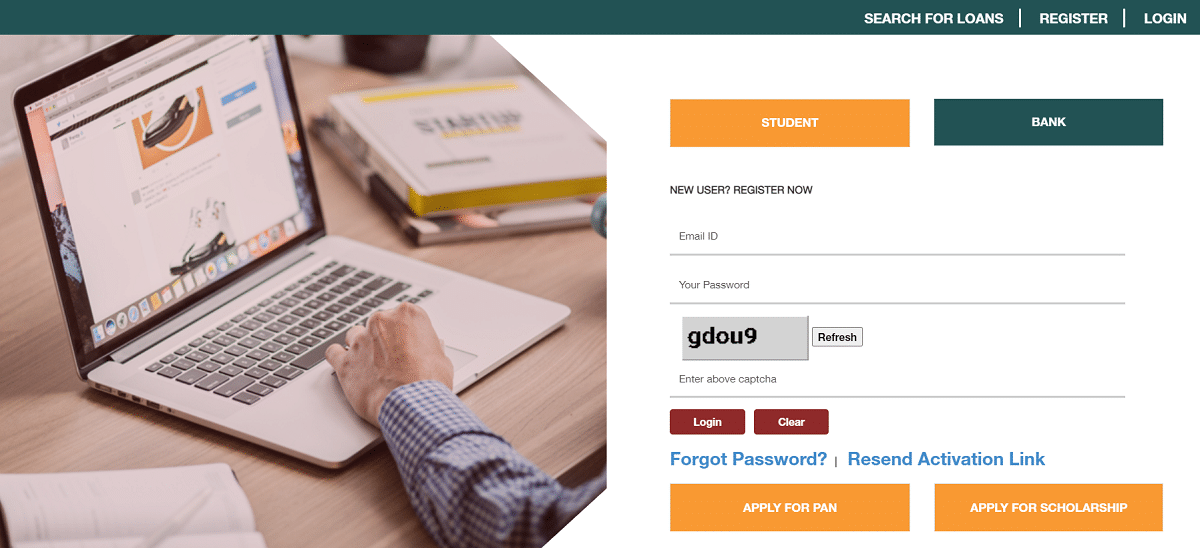

STEP 8: After registration, candidate can make “Student Login” using the link by entering his/her email and password.

STEP 9: After making login, candidate have to click on “Kalinga Sikhya Sathi Yojana (KSSY) Application Form” link.

STEP 10: Application form will be appeared on the next page, fill all details in form and submit.

Check complete process for Vidyalakshmi Portal Registration / Login

Kalinga Sikhya Sathi Yojana Approved by Odisha Cabinet

Kalinga Sikhya Sathi Yojana, an education loan scheme which was launched in June 2016 after approval by the state cabinet. Under the Kalinga Sikshya Sathi Yojana, the meritorious students would be provided education loans at just 1% of interest rates to achieve their dreams of higher education. The loan, however, would be given only to candidates whose annual household income is less than Rs. 6.00 Lakh.

The loans under the new scheme would be available to students who are willing to take higher education in medical, engineering, management, law and other fields.

Launch of Kalinga Sikshya Sathi Yojana as Education Loan Scheme in Odisha

Chief Minister Naveen Patnaik has launched a new education loan scheme for poor meritorious students in the state. Named as “Kalinga Sikshya Sathi Yojana” the state government will provide education loans at interest of just 1 percent per annum to the poor students.

Objective of Kalinga Sikshya Sathi Yojana

The objective of the scheme is to ensure that the meritorious students from the poor families enroll into the higher studies. Until now, many such students does not enroll into the higher studies due to lack of the funds, but Kalinga Sikshya Sathi Yojana will ensure help to such students and their better future.

The students wants to undergo higher studies in education, medical, engineering, management, law and others can avail the education loan under the new scheme. The scheme will definitely reduce the burden of education loans and financial stress on the poor households across the state. On the next day of launch, students also thanked Mr. Chief Minister by visiting his residence. The state government has dedicated this scheme to former Chief Minister Biju Patnaik on his birth centenary.

Modification in KSSY in respect of education loans for students of Odisha pursuing higher studies in technical / professional courses (4 August 2017) – http://dheodisha.gov.in/DocPath.ashx?clsid=1&id=9_1_2018_5_34_35_PM20285.pdf

Modification in Interest Subvention Scheme KSSY in respect of Education loans (28 August 2018) – http://dheodisha.gov.in/DocPath.ashx?clsid=1&id=9_1_2018_5_40_36_PM24467.pdf

KSSY Grievance Box

If you have been admitted in any professional course and also contacted bank personnel regarding loan, but still you have doubts / grievance then submit your grievance in the Grievance Box – http://dheodisha.gov.in/KSSY/FeedbackKSSY.aspx

Check Frequently Asked Questions at http://dheodisha.gov.in/KSSY/pdf/FAQ_KSSY_Revd.pdf

from सरकारी योजना

via

0 टिप्पणियाँ