Union Finance Minister has launched facility for MSME credit space to apply online for MSME business loans in 59 minutes at psbloansin59minutes.com. This common online web portal will enable in-principle approval for MSME loans upto Rs. 1 crore in just 59 minutes from SIDBI (small industries development bank) and 5 other public sector banks (PSBs). Now any person can apply online for MSME business loans in 59 minutes. This initiative reimagines and simplifies overall process of fund raising and is designed to ease access of credit to individuals and MSMEs.

PSB 59 Minute Loan Yojana

PSB loans in 59 minutes is a unique platform that ensures seamless in-principle loan approval. The initiative aims at automation and digitization of various processes of Business Loan (Term Loan, Working Capital Loan and Mudra Loan) and Retail Loans (Personal Loan, Home Loan and Auto Loan) in such a way that a borrower gets an In-principle approval letter in less than 59 minutes. The borrower has been given the flexibility to choose lender.

The newly launched common web portal for MSME business loans will reduce the loan processing and turnaround time from 20 to 25 days to just 59 minutes. After the applicant gets in-principle approval, then the loans will be be disbursed within a time span of 7 to 8 days. PM Modi had earlier launched MSME support and outreach initiative on 2 November 2018 through video conferencing.

PSB MSME Business Loans in 59 Minutes – Apply Online

A new portal is launched by the central government in collaboration with SIDBI and 20 banks have been choosen to provide MSME loans in a faster manner. Below is the complete procedure on how to make registration and apply online for MSME business loans in just 59 minutes:-

STEP 1: Firstly visit the official website https://www.psbloansin59minutes.com/home

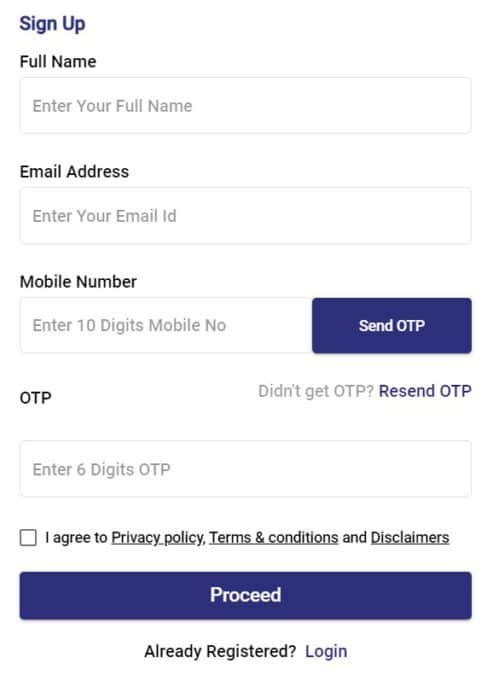

STEP 2: At the homepage, businesses needs to make online registration by filling the sign up form before applying online for MSME business loans as shown in the figure:-

STEP 3: All the existing businesses and new businesses can fill this registration form by entering the necessary details like name, e-mail ID and mobile phone number. OTP will be sent on the registered mobile number which needs to be entered for verification and then click at “Proceed” button.

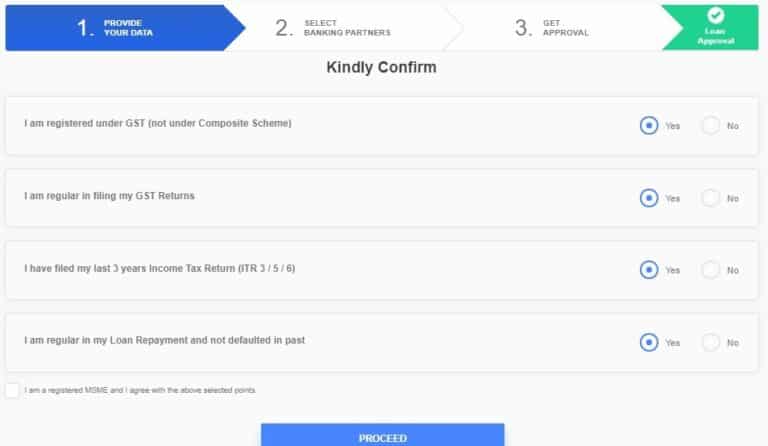

STEP 4: Then change your password, select your requirement as “Need Fund for Existing / New Business” to open the MSME business loans online application form as shown below:-

STEP 5: Here candidates have to provide data, select banking partners and get approval for sanctioning of loans.

STEP 6: All the existing members can make login to access their details from the next time by just entering their e-mail ID or mobile number.

After the submission of online application form by the businesses, this portal will perform back end checks before loan approval. This web portal is linked with the ministry of corporate affairs and credit information bureau for fraud and products check before sanctioning of loans. For speedier loans sanction, businesses needs to submit their GST and Income Tax (IT) details along with bank statement.

By linking online loan approvals with GST and IT returns, govt. can also get to know and reward those businesses who are a part of formal economy. For documents list to be submitted by the existing / new businesses and more details, visit the official website psbloansin59minutes.com

PSB 59 Minutes Business Loan – How It Happens

Firstly applicants will have to enter the GST Identification number, next enter Income Tax returns in XML format. Then upload bank statement for last 6 months in PDF format and next enter director / owner details (basic, personal, educational & ownership details). Then in principal approval for PSB 59 Minutes Business Loan is provided within 59 minutes.

Personal / Home / Auto Loan – How it Happens in 59 Minutes

Firstly applicants will have to enter income tax returns in XML format, next enter bank statement for last six months in PDF format. Then applicants can enter personal details such as basic and employment details, next enter the loan detail purpose and other details. Finally applicants will get personal / home / auto loan in principle approval within 59 minutes.

Value of Business / Personal Loan In Principle Approvals

Business Loan In-principle approvals, with / without collateral, are currently provided for value from Rs. 1 lakh to Rs. 5 crore. The rate of interest starts from 8.5% onward. The platform is integrated with CGTMSE to check eligibility of borrowers. Mudra Loans in principal approvals are currently provided for value from Rs. 10,000 to Rs. 10 lakhs.

Personal Loan In-principle approvals are currently provided for value up to INR 20 Lacs, Home Loan In-principle approvals are currently provided for value up to INR 10 Crores and Auto Loan In-principle approvals are currently provided for value up to INR 1 Crore.

MSME Business Loan initiative reimagines and simplifies overall process of fund raising and has been designed to ease access of credit to individual and MSMEs. It is a unique platform that ensures seamless in principle loan approval.

59 Minute Loan Yojana Partner Banks List

Here is the complete list of partner banks in 59 Minute Loan Yojana by PSB along with SIDBI:-

| State Bank of India (SBI) | Bank of Baroda (BOB) |

| Punjab National Bank (PNB) | Indian Bank |

| Bank of India (BOI) | Bank of Maharashtra |

| Syndicate Bank | Central Bank of India |

| IDBI Bank | Indian Overseas Bank |

| Punjab & Sind Bank | UCO Bank |

| Union Bank | Kotak Mahindra Bank |

| IDFC First Bank | IndusInd Bank |

| Saraswat Co-operative Bank Ltd. | ICICI Bank |

| Yes Bank | Federal Bank |

MSME Outreach & Support Drive by PM Modi – Features

All the micro, small and medum enterprises can avail loans upto Rs. 1 crore in just 59 minutes and a lot more from this massive MSME outreach and support drive:-

- SMEs would be able to access credit easier and faster.

- All the SMEs will now have an improved cash flow system.

- SMEs will gain more access to the market to sell their products.

- SMEs will get simpler regulatory compliance and ease of doing business.

- All the SME employees can now avail more social security benefits.

- SMEs would also be benefited from formalisation and GST enrolment.

Department of Financial services, Ministry of Finance is the nodal agency for the implementation of MSME Outreach and support drive. This initiative was earlier started by the PM Narendra Modi on 2 November 2018.

Financial Inclusion Index (FII)

FII will be the measure of access and usage of a basket of formal financial services and products. This would includes savings, remittances, credit, insurance and pension products. Financial inclusion index will contain 3 measurement dimensions which are as follows:-

- Access to financial services and products.

- Usage of financial services and products.

- Quality of financial services and products.

Jan Dhan Darshak – Banking Services Infrastructure Locator App

Central govt. has also launched a new Jan Dhan Darshak App which will serve as infrastructure locator for banking services. This app aims to bring banking services within the reach of common man through over 5 lakh banking touch points. This touch points will include bank branches, ATMs, banking correspondents, common service centers (CSCs) and post offices.

GIS (geographic information system) mapping would help in identification of the nearest banking touch point. Now, the govt. is focusing on ensuring that every household must get banking services within 5 kilometers range from their houses.

PSB Loans in 59 Minutes FAQs

1. What is PSB Loans in 59 Minutes Initiative?

The PSB Loans initiative re-imagines and simplifies the overall process of fund raising. It has been designed to ease access of credit to Individuals and MSMEs. https://ift.tt/2qDYwPI is a unique platform that ensures seamless In-principle loan approval.

2. Is this initiative Digitization of Bank Loans?

Yes, the initiative aims at automation and digitization of various processes of Business Loan (Term Loan, Working Capital Loan and Mudra Loan) and Retail Loans (Personal Loan, Home Loan and Auto Loan) in such a way that a borrower gets an In-principle approval letter in less than 59 minutes.

3. From Which Bank Applicant will Get Loan Amount?

The borrower has been given the flexibility to choose lender i.e any applicant can choose any bank from which people wants to avail loans.

4. What is the Value of Business Loan for Which In-Principal Approval is Provided?

Business Loan in-principle approvals with /without collateral are currently provided for value from Rs. 1 Lakh to Rs. 5 crore. The rate of interest starts from 8.5% onward. The platform is integrated with CGTMSE to check eligibility of borrowers.

5. What is the Value of Mudra Loan for Which In-Principal Approval is Provided?

Mudra Loan in-principle approvals are currently provided for value from Rs. 10,000 to Rs. 10 Lakhs.

6. What is the Value of Personal Loan for Which In-Principal Approval is Provided?

Personal Loan in-principle approvals are currently provided for value up to Rs. 20 Lakhs.

7. What is the Value of Home Loan for Which In-Principal Approval is Provided?

Home Loan in principle approvals are currently provided for value up to Rs. 10 Crores and auto Loan in-principle approvals are currently provided for value up to Rs. 1 Crore.

8. How Facility for Common Online Web Portal Will Help?

The common online web portal will enable in-principle approval for MSME loans upto Rs. 1 crore in just 59 minutes from SIDBI (small industries development bank) and 5 other public sector banks (PSBs).

9. Which are Partner Banks of PSB Loans in 59 minutes?

Sidbi, SBI, Bank of Baroda, Punjab National Bank, Indian Bank, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank of India, IDBI Bank, Indian Overseas Bank, Punjab & Sind Bank, UCO Bank, Union Bank of India, Kotak Mahindra Bank, IDFC First, Sarrasswat and Indusind bank are partner banks of PSB loans in 59 minutes.

Quick Links for MSME Business Loans in 59 Minutes

Direct Link to Register – https://www.psbloansin59minutes.com/signup

Direct Link for Login – https://www.psbloansin59minutes.com/login

E-Mail ID – support@psbloansin59minutes.com

Helpline Number – 079-41055999

from सरकारी योजना

via

0 टिप्पणियाँ