PM Jan Dhan Yojana 2021 is a national mission of the central government for financial inclusion of poor people. Under this PMJDY, all the people from economically weaker sections can open zero balance Jan Dhan Yojana Account in banks (savings & deposits account). This account will provide them various yojana benefits directly into their account like remittance, credit, insurance and pension. For this, candidates can see yojana rules and download pradhan mantri jan dhan yojana form at pmjdy.gov.in

People can easily open jan dhan account in any bank branch or with business correspondent (bank mitr). If any person does not possess the officially valid documents then he can open small account subject to the jan dhan yojana rules. Moreover, people can also avail jan dhan yojana loan through any bank.

People can avail all the jan dhan yojana benefits through pdf download of the application form and opening an account. In these accounts, there is also a facility of Rupay Card, Kisan Credit Card (if eligible) and an overdraft (after 6 months of account opening and successful operation).

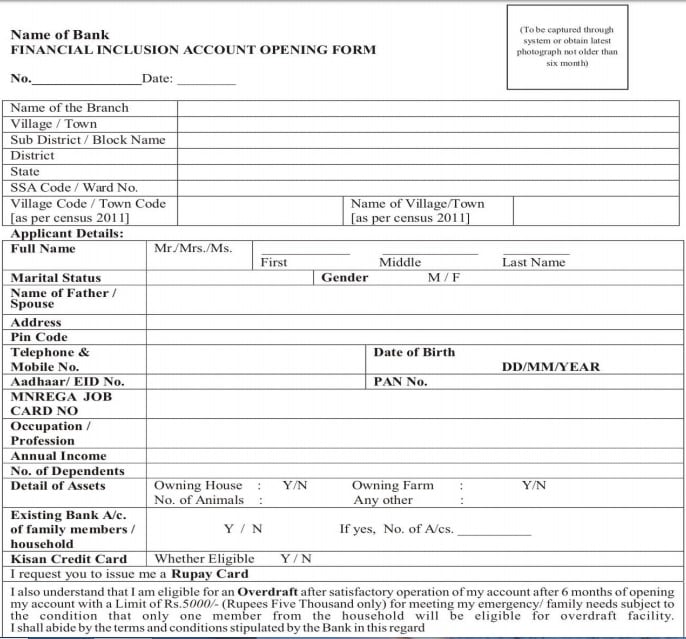

Pradhan Mantri Jan Dhan Yojana Form – Account Opening

All the interested individuals who wishes to open their personal savings account can download this application form. PM Jan Dhan Yojna Form must be dully filled and submitted along with necessary documents. In case the officially valid documents are not present, then poor people can open their small account. To download the application form in pdf format, click the link given below:-

PM Jan Dhan Yojana Form (PDF) – English

PM Jan Dhan Yojana Form (PDF) – Hindi

- Accordingly, Pradhan Mantri Jan Dhan Yojana Account Opening Form will appear as follows:-

- Fill in all the necessary details along with the nominee details. People can avail nomination facility at the time of account opening.

- Finally, candidates can submit this form along with necessary documents to open their zero balance account.

Jan Dhan Yojana Loan Apply – People can apply for Loan in SBI / ICICI / HDFC / Axis and other nationalized banks through the link – Jan Dhan Yojana Loan

List of Documents to Open Jan Dhan Yojana Account

If Aadhaar Card/Aadhaar Number or proof of possession of Aadhar is available then no other documents are required. If address has changed, then a self-certification of current address is sufficient. If Aadhaar Card is not available, then any one of the following Officially Valid Documents (OVD) is required. All the documents given below are officially valid documents. Candidates can submit any one of these documents along with their recent photographs and filled application form to open PMJDY Account.

OVD Documents for Opening Jan Dhan Yojana Account –

| Passport | Driving Licence (DL) |

| MNREGA Job Card | Voter Id Card |

If these documents also contain your address, it can serve both as “Proof of Identity and Address”. If a person does not have any of the “officially valid documents” mentioned above, but it is categorized as ‘low risk’ by the banks, then he/she can open a bank account in a Bank Branch by submitting any one of the following documents:

- Identity Card with applicant’s photograph issued by Central/State Government Departments, Statutory/Regulatory Authorities, Public Sector Undertakings, Scheduled Commercial Banks and Public Financial Institutions;

- Letter issued by a gazette officer, with a duly attested photograph of the person.

PM Jan Dhan Yojana New Rules

Pradhan Mantri Jan-Dhan Yojana (PMJDY) is National Mission for Financial Inclusion to ensure access to financial services, namely, a basic savings & deposit accounts, remittance, credit, insurance, pension in an affordable manner. Under the scheme, a basic savings bank deposit (BSBD) account can be opened in any bank branch or Business Correspondent (Bank Mitra) outlet, by persons not having any other account. There are certain special benefits under PMJDY Scheme which are as follows:-

- One basic savings bank account is opened for unbanked person.

- There is no requirement to maintain any minimum balance in PMJDY accounts.

- Interest is earned on the deposit in PMJDY accounts.

- Rupay Debit card is provided to PMJDY account holder.

- Accident Insurance Cover of Rs.1 lakh (enhanced to Rs. 2 lakh to new PMJDY accounts opened after 28.8.2018) is available with RuPay card issued to the PMJDY account holders.

- An overdraft (OD) facility up to Rs. 10,000 to eligible account holders is available.

- PMJDY accounts are eligible for Direct Benefit Transfer (DBT), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana (APY), Micro Units Development & Refinance Agency Bank (MUDRA) scheme.

Extension of PMJDY Program

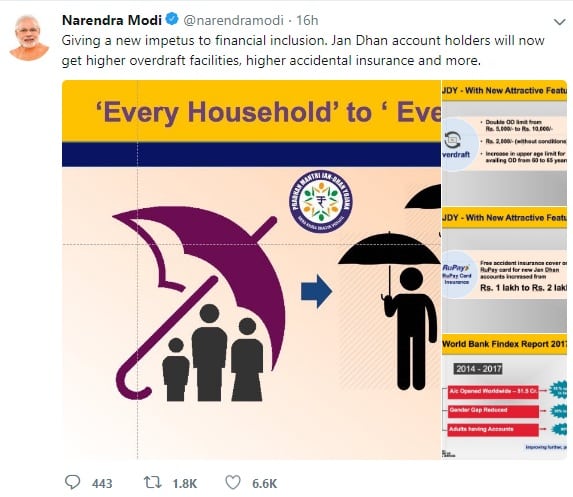

The Government has decided to extend the comprehensive PMJDY program beyond 28.8.2018 with the change in focus on opening accounts from “every household” to “every adult”, with following modification:

- Existing Over Draft (OD) limit of Rs. 5,000 revised to Rs. 10,000.

- No conditions attached for active PMJDY accounts availing OD upto Rs. 2,000.

- Age limit for availing OD facility revised from 18-60 years to 18-65 years.

- The accidental insurance cover for new RuPay card holders raised from existing Rs.1 lakh to Rs. 2 lakh to new PMJDY accounts opened after 28.8.2018.

Progress Report of PMJDY Scheme

| Bank Name / Type | Total Beneficiaries | Deposits in Accounts (in Crore) | Number of Rupay Debit Card Issued to Beneficiaries |

| Public Sector Banks | 34.48 | 113890.92 | 27.14 |

| Regional Rural Banks | 7.94 | 27967.51 | 3.38 |

| Private Sector Banks | 1.27 | 4373.93 | 1.11 |

| Grand Total | 43.70 | 146232.36 | 31.64 |

Beneficiaries as on 20 October 2021. Disclaimer: Information is based upon the data as submitted by different banks

Jan Dhan 2 Scheme – PM Jan Dhan Yojana Open Ended with More Incentives

Central Govt. has decided to make Pradhan Mantri Jan Dhan Yojana an Open Ended Scheme. Under this Jan Dhan 2 Scheme, govt. has now added more number of incentives in order to encourage poor people to open zero balance bank accounts. PM Jan Dhan Yojana scheme was launched in August 2014 for 4 years which is later extended. 1st phase of PMJDY scheme was completely focused on opening basic bank accounts. People also got RuPay debit cards with inbuilt accident insurance cover of Rs. 100,000.

PM Jan Dhan Yojana is the biggest financial inclusion scheme in the entire World. Now the govt. wants to make scheme more open ended with more incentives keeping in view of its “runaway success”. So, central govt. has decided to launch Jan Dhan 2 Scheme. Now the over-draft limit for account holders has now been doubled to Rs. 10,000.

Jan Dhan 2 Scheme – PMJDY is Now Open Ended with More Incentives

The important features which have been included in Pradhan Mantri Jan Dhan Yojana are as follows:-

- Accidental Insurance Now Rs. 2 Lakh – All the people who opens new Jan Dhan Bank Accounts after 28 August 2018 will now get Free Accident Insurance Cover of double amount of Rs. 2 lakh.

- Over-draft Limit Now Rs. 10,000 – Now there would be no conditions attached for overdraft of upto Rs. 2,000. Now the maximum limit for over-draft is set at Rs. 10,000 (previously Rs. 5,000). IN PMJDY, this facility is available after 6 months of opening bank accounts. Over-Draft facility means that the account holder can withdraw money from his account which is more than the actual balance present in bank account.

- Upper Age Limit now 65 Years – Also the upper age limit to avail the Jan Dhan Yojana facility is now raised from 60 years to 65 years.

- There are around 43.70 crore Jan Dhan Account holders and total deposit balance has now reached to Rs. 1,46,232.36 crore (as on 20 October 2021).

- Now the Central govt. has decided to continue the flagship PM Jan Dhan Yojana financial inclusion scheme. PMJDY will now focus on opening account from every household to every adult.

Jandhan-Aadhaar-Mobile (JAM) linking will continue to provide the essential backbone to cover various activities. This includes Banking / Savings & Deposit Accounts, Remittance, Credit, Insurance, Pension in an affordable manner.

This decision to make Pradhan Mantri Jan Dhan Yojana an open ended scheme will accelerate the pace of digitised financially included and insured society. In Jan Dhan 2 Scheme, overdraft is raised to Rs. 10,000, Upper Age limit is now 65 years and accidental insurance now Rs. 2 lakh.

References

— In case of further query, please call National Toll Free Number: 1800-11-0001 or 1800-180-1111.

— For more details on Pradhan Mantri Jan Dhan Yojana, please visit the official website pmjdy.gov.in

from सरकारी योजना

via

0 टिप्पणियाँ