PPF Account Opening Form 2021 / Interest Rate / Calculator: Public Provident Fund (PPF) is a savings cum tax saving long term investment option introduced in 1968 by Indian Post. Subsequently, the main aim of opening of PPF account is to mobilize small savings through investment with reasonable returns in addition to income tax benefits. Accordingly, PPF calculator can be used to calculate the PPF rate of interest which is currently fixed at 7.1% p.a compounded yearly by central government.

Post Office Public Provident Fund Account

PPF Scheme is a long term debt scheme of Indian govt. on which govt. provides regular interest. Any individual whether belonging to a salaried class or self employed can make investment in PPF scheme and can open his PPF account. PPF rate of interest is higher than that of Bank Savings account and Fixed deposit. People can Compare All Post Office Schemes before making investment.

People can open their ppf account in post office or some authorized branches of bank. Bank permits deposits in ppf account online. NRI candidates are not allowed to invest in Pubic Provident Fund Scheme. Check PPF vs NSC (National Saving Certificate) vs Kisan Vikas Patra KVP vs Sukanya Samriddhi Yojana (Girls) vs Post Office Savings Account vs Senior Citizen Saving Scheme (SCSS) vs Recurring Deposit – RD Account vs Time Deposit Account (TD) vs Monthly Income Scheme (MIS)

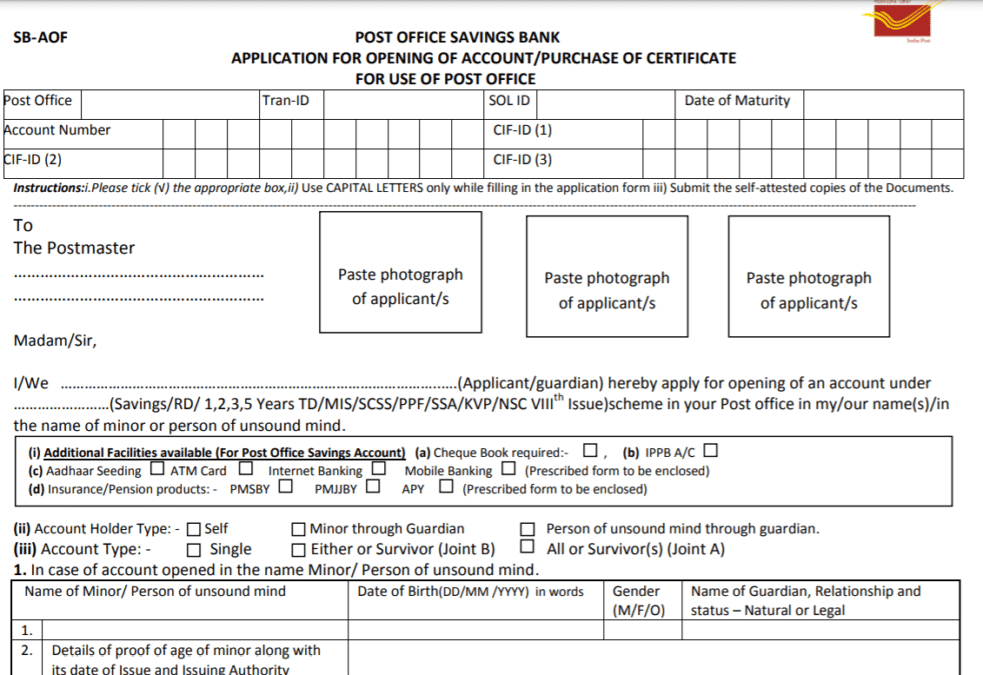

Indian Post Office PPF Account Opening Form

In order to download PPF Account Opening Form, hit direct link – https://www.indiapost.gov.in/VAS/Pages/Form.aspx#SavingBank

The PPF Account Opening Form 2021 will appear as shown below:-

Applicants must download this PPF account opening form, take a printout, fill it and then submit it at the nearest Post Office of your area.

Who can open PPF Account

(i) A single adult by a resident Indian.

(ii) A guardian on behalf of minor/ person of unsound mind .

Note:- Only one account can be opened all across the country either in Post Office or any Bank.

Deposits – Minimum and Maximum PPF Account Balance

Person will have to fill Form A along with subscription amount. On Receiving application for, Accounts Officer will open the account and issue a new passbook. This ppf passbook will consists information of all ppf deposits, ppf loans and ppf withdrawal. As per the Public Provident Fund Act of 1968, minimum ppf account balance to be deposit in the account is Rs. 500 per year. Moreover, the central government has increase the maximum ppf account balance limit from 1 lakh to 1.5 lakh in FY 2014.

- Minimum deposit Rs. 500 in a Financial Year and Maximum deposit is Rs. 1.50 lakh in a FY

- Maximum limit of Rs. 1.50 lakh shall be inclusive of the deposits made in his/her own account and in the account opened on behalf of minor.

- Amount can be deposited in any number of installments in a FY in multiple of Rs. 50 and maximum up to Rs. 1.50 lakh.

- Account can be opened by cash/cheque and in case of cheque the date of realization of cheque in Govt. account shall be date of opening of account/subsequent deposit in account.

- Deposits qualify for deduction under section 80C of Income Tax Act.

People can deposit this amount in lump sum or in 12 monthly installments.

Discontinuation of PPF Account

(i) If in any financial year, minimum deposit of Rs.500/- is not made, the said PPF account shall become discontinued.

(ii) Loan/withdrawal facility is not available on discontinued accounts.

(iii) Discontinued account can be revived by the depositor before maturity of the account by deposit minimum subscription (i.e. Rs. 500) + Rs. 50 s default fee for each defaulted year.

(iv) The total deposit in a year, shall be inclusive of deposits made in respect of years of default of previous financial years.

PPF Interest Rate / Rate of Interest

The current PPF Interest Rate is 7.1% per annum compounded yearly. Here are some of the important points regarding PPF Account Rate of Interest:-

- Interest shall be applicable as notified by Ministry of Finance on quarterly basis.

- The interest shall be calculated for the calendar month on the lowest balance in the account between the close of the fifth day and the end of the month.

- Interest shall be credited to the account at the end of each Financial year.

- Interest shall be credited to the account at the end of each FY where account stands at the end of FY. (i.e. in case of transfer of account from Bank to PO or vice versa)

- Interest earned is tax free under Income Tax Act.

Loan to PPF Account Holders

- Loan can be taken after the expiry of one year from the end of the FY in which the initial subscription was made.(i.e. A/c open during 2010-11, loan can be taken in 2012-13).

- Loan can be taken before expiry of five years from the end of the year in which the initial subscription was made.

- Loan can be taken up to 25% of balance to his credit at the end of the second year immediately preceding the year in which loan is applied. (i.e. if loan taken during 2012-13, 25% of balance credit on 31.03.2011)

- Only one loan can be taken in a Financial Year.

- Second loan shall not be provided till first loan was not repaid.

- If loan repaid within 36 month of the loan taken, loan interest rate @ 1% per annum shall be applicable.

- If loan repaid after 36 month of the loan taken loan interest rate @ 6% per annum shall be applicable from the date of loan

PPF Withdrawal

A subscriber can take 1 withdrawal during a financial after five years excluding year of account opening. (if account open during 2010-11 the withdrawal can be taken during or after 2016-17).

Amount of withdrawal can be taken up to 50% of balance at the credit at the end of 4th preceding year or at the end of preceding year, whichever is lower. (i.e. withdrawal can be taken in 2016-17, up to 50% of balance as on 31.03.2013 or 31.03.2016 whichever is lower).

PPF Account Maturity Period

Account will be maturity after 15 F.Y. years excluding FY of account opening. On maturity depositor has the following options:-

- Can take maturity payment by submitting account closure form along with passbook at concerned Post Office.

- Can retain maturity value in his / her account further without deposit, the PPF interest rate will be applicable and payment can be taken any time or can take withdrawal in each FY.

- Can extend his / her account for further block of 5 years and so on (within one years of maturity) by submitting prescribed extension form at concerned Post Office.

- Discontinued account cannot be extended.

- In extended accounts with deposits, 1 withdrawal can be taken in each FY subject to maximum limit 60% of balance credit at the time of maturity in the block of 5 years.

PPF Account Premature closure

Premature closure shall be allowed after 5 years from the end of the year in which the account was opened subject to following conditions:-

- In case of life threatening disease of account holder, spouse or dependent children.

- In case of higher education of account holder or dependent children.

- In case of change of resident status of account holder ( i.e. became NRI).

At the time of premature closure 1% interest shall be deducted from the date of account opening/date of extension as the case may be. Account can be closed on above conditions by submitting prescribed form along with pass book at concerned Post Office.

Death of PPF Account Holder

In case of death of account holder, the account shall be closed and nominee or legal heir(s) shall not be allowed to continue deposits in the account. At the time of closure due to death PPF rate of interest shall be paid till the end of the preceding month in which account is closed.

PPF Rules

To know the complete details of the Public Provident Fund Account, check PPF Rules through the link mentioned here:- https://www.indiapost.gov.in/VAS/DOP_PDFFiles/Savings%20Bank/Public%20Provident%20Fund%20Scheme%202019%20English.pdf

Public Provident Fund Tax Benefit / PPF Tax Benefits

In Public Provident Fund Scheme, there are 2 types of amount – first is the principal amount which a person deposits and second is the interest earned. PPF Account has tax benefits on both these amount which are as follows:-

PPF Tax benefit on Principal Amount – PPF principal amount will get deduction from Gross Total Income under 80C of IT Act. However, this amount is limited to Rs. 1.5 lakh per annum. For rest amount, subscriber will have to pay tax as per their income tax slab.

PPF Tax Benefit on Interest Earned – Interest earned is absolutely tax free and govt. cannot levy any income tax on this amount.

PPF Calculator

People can calculate their ppf interest earned, ppf closing balance, max loan and ppf withdrawal on an yearly basis on the amount deposited through the PPF Calculator link given here – https://groww.in/calculators/ppf-calculator/

Salient Features of PPF Account

Either Father or Mother can open PPF account in the name of a minor. However, both are not allowed to open this account in the name of minor. Even grand parents can not open this type of account for minor but can act as guardian in case both the parents of minor are dead. The important features and PPF account rules are given below:-

- People must deposit minimum Rs. 500 per year in their PPF account. The maximum limit is Rs. 1,50,000 per year. Any Indian Person can deposit money in lump sum or in installments.

- Maximum limit of Rs. 1.50 lakh shall be inclusive of the deposits made in his/her own account and in the account opened on behalf of minor.

- Amount can be deposited in any number of installments in a FY in multiple of Rs. 50 and maximum up to Rs. 1.50 lakh.

- Account can be opened by cash/cheque and in case of cheque the date of realization of cheque in Govt. account shall be date of opening of account/subsequent deposit in account.

- A single adult by a resident Indian or a guardian on behalf of minor/ person of unsound mind can open this account.

- Only one account can be opened all across the country either in Post Office or any Bank.

- Subsequently, Joint account opening is not permitted in Public Provident Fund Scheme.

- If in any financial year, minimum deposit of Rs. 500/- is not made, the said PPF account shall become discontinued.

- Loan/withdrawal facility is not available on discontinued accounts.

- Discontinued account can be revived by the depositor before maturity of the account by deposit minimum subscription (i.e. Rs. 500) + Rs. 50 s default fee for each defaulted year.

- The total deposit in a year, shall be inclusive of deposits made in respect of years of default of previous financial years.

- Moreover, the nomination facility is available at the time of opening of account and remains applicable even after the account is opened. If a person does not specify his nominee and the account holder dies then the entire amount will get passed to the legal heirs. In addition to this, account also has transfer facility i.e it can be transferred from 1 post office to another.

- Subscriber can also open another account in name of minor but the maximum investment limit (adding balance in all accounts) needs to be followed.

- People also receive tax benefits through investment in Public Provident Fund. All the deposits qualifies for income deduction under section 80C of IT Act. Moreover, the interest amount is non-taxable (free from tax).

- In addition to this, Post Office / Banks also provides loan facility to PPF Account holders.

People can open PPF account in a Post Office or nationalized banks (PPF SBI, PPF PNB, PPF Central bank of India) and other banks (PPF ICICI, PPF HDFC, PPF Axis Bank etc.). However each individual is permitted only to open one ppf account. For complete PPF account features, click the link – https://www.indiapost.gov.in/Financial/Pages/Content/Post-Office-Saving-Schemes.aspx

For more information on Public Provident Fund Scheme, please visit the official website indiapost.gov.in

from सरकारी योजना

via

0 टिप्पणियाँ