Telangana Rythu Bheema Pathakam Apply Online | TS Rythu Bima Pathakam Application Status | Rythu Bheema Pathakam Farmer List | Telangana Rythu Bandhu Life Insurance Bonds Scheme. Telangana government has started Farmers Group Life Insurance Scheme or Rythu Bheema Pathakam Scheme for the welfare of farmers. In this article, we will share all the details regarding the TS Rythu Bima Scheme including the eligibility criteria, documents required, benefits, objectives and features. After reading this article, you can know step by step procedure through which you will be able to apply for TS Farmers Insurance scheme.

Telangana Rythu Bheema Pathakam Scheme 2021 Details

The state govt. of Telangana has started Rythu Bheema Pathakam Scheme to guarantee the monetary and standardized savings to the farmers. TS Rythu Bima Scheme has been conceptualized and executed as an innovative plan named as Farmers Group Life Insurance Scheme along with different activities in agribusiness segment. Telangana Rythu Bandhu Life Insurance Bonds Scheme is first of its sort and one of a kind in the nation as it is implemented based on farmer-wise online land data base through Information Technology and Online Portals and MIS that are being used by all the outreach officers for effective and efficient implementation.

Objectives of TS Rythu Bheema Pathakam Scheme

- The main objective of the Farmers Group Life Insurance Scheme (Rythu Bima), is to provide financial relief and social security to the family members/ dependents, in case of loss of farmer’s life due to any reason.

- In the event of the loss of the farmer life, their families are facing severe financial problems even for their day-to-day needs.

- The farmers Group Life Insurance Scheme ensures financial security and relief to the bereaved members of the farmer’s family.

- Farmers in the age group of 18 to 59 years are eligible for enroll under the Telangana Rythu Bima Scheme.

- The entire premium is paid by the government to the Life Insurance Corporation of India (Largest public sector PSU for Insurance in India).

- In the event of the death of the enrolled farmer due to any cause including natural death, the insured amount of 5.00 Lakhs INR (Approx. USD 6928) is deposited into the designated nominee account within (10) days.

- Telangana Rythu Bheema Pathakam Scheme has a tremendous impact on the lives of the bereaved families and helping their livelihoods, since most of them are resource poor small farmers and belong to weaker sections of the society.

Overview of TS Rythu Bheema Pathakam Scheme

| Name of Scheme | Rythu Bheema Pathakam Scheme |

| State | Telangana |

| Launched by | Chief Minister K Chandrashekhar Rao (KCR) |

| Launched for | Farmers of Telangana state |

| Benefit | To provide life insurance cover to all farmers |

| Official Website | http://rythubandhu.telangana.gov.in/Default_LIC1.aspx |

Telangana Rythu Bima Pathakam Benefits

Telangana Rythu Bima Scheme is a Farmers Group Life Insurance in which the state govt. will provide the insured amount of Rs. 5 lakh would be directly deposited into the designated nominee account within 10 days in case of death of the enrolled farmer due to any cause including natural death.

TS Rythu Bheema Pathakam Statistics

| Districts | 32 |

| Divisions | 108 |

| Mandals | 568 |

| Clusters | 2245 |

| Villages | 10874 |

| Farmers | 5715870 |

Telangana Rythu Bima Scheme Eligibility Criteria

Here is the complete eligibility criteria to apply online for Telangana Rythu Bima Scheme:-

- Applicants must be a permanent resident of Telangana state.

- The applicant must be a farmer by profession.

- A farmer must own some agricultural land.

- The applicants who work on rental land not applicable to apply for the scheme.

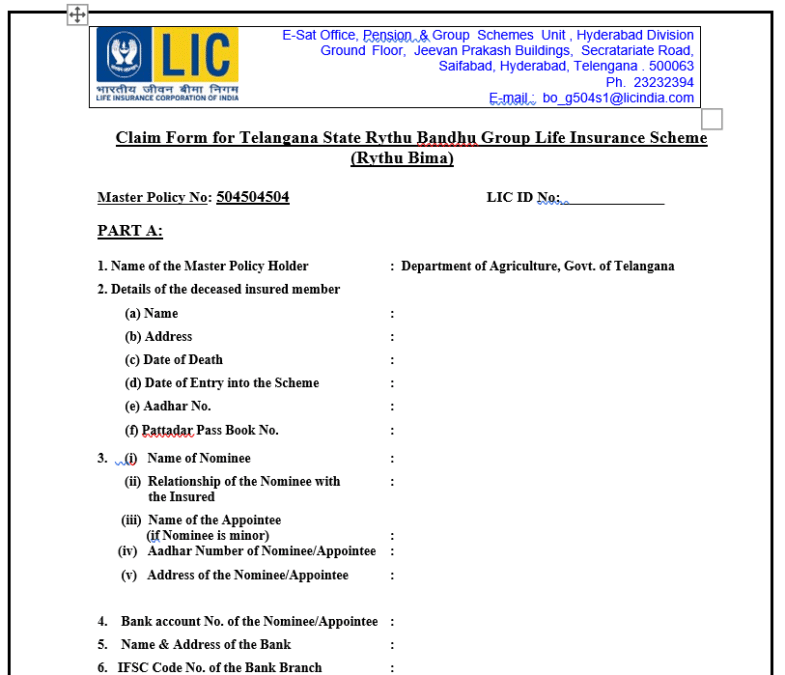

Rythu Bheema Pathakam Claim Form Download

In order you want to claim your insurance money after the death of your close relatives who was a farmer then you will have to follow the simple procedure:-

- Firstly visit the official website of Rythu Bheema Pathakam at http://rythubandhu.telangana.gov.in/Default_LIC1.aspx

- Now you have to download Rythu Bima claim form through the link given here.

- While collecting the body of your relative, you have to fill out this claim form and submit to the hospital.

- You can submit the documents at the LIC Bank.

- You will also have to submit the death certificate with this form.

- Then concerned authority will forward the money to the beneficiary account.

At the official portal, you can even make department login through the link – http://rythubandhu.telangana.gov.in/Login.aspx.

Telangana Rythu Bheema Pathakam Application Status

All the applicants can now check TS Rythu Bheema Pathakam Application Status for the insurance money while visiting the LIC Bank once in a while till your claim has not been settled by the concerned authorities. LIC concerned authorities mentioned that the insurance claim will be settled as soon as possible after the death of the farmer due to common reasons.

TS Rythu Bheema Pathakam Scheme App Download

Rythu Bheema Pathakam mobile application is also available which will help you in getting all the latest information about the scheme on your figure tips. You can download the application from the official website by following few easy steps:-

- Firstly visit at the official Website of TS Rythu Bheema Pathakam Scheme at http://rythubandhu.telangana.gov.in/Default_LIC1.aspx

- At the homepage, you can click at “Download Mobile App” option or directly click this link

- Telangana Rythu Bima App will automatically start downloading, install the mobile application in your smartphone.

- Give the necessary permissions and login/ register on it to avail benefits of Farmers Insurance Scheme.

TS Rythu Bheema Pathakam Helpline Number

If you have any query related to the scheme, you may contact the district nodal officer of your district or call on 040 2338 3520 or email at comag-ts@nic.in. Phone numbers are mentioned below:-

| District | Officer Name | Mobile No |

| Adilabad | K.Shiva Kumar | 7288894006 |

| Bhadradri Kothagudem | B. Arun Kumar | 7288894275 |

| Jagtial | G. Kalpana | 7288894120 |

| Jangoan | K. Anil Kumar | 7288894791 |

| Jayashankar Bhupalpalli | B. Vinay | 7288894788 |

| Jogulamba Gadwal | C.Aswini | 7288878426 |

| Kamareddy | S. Narasimhulu | 7288894550 |

| Karimnagar | M. Krishna | 7288894113 |

| Khammam | J. Uma Nagesh | 7288894204 |

| Kumuram Bheem (Asifabad) | K. Srinivas | 7288878978 |

| Mahabubabad | V.RAJANARENDER | 7288894780 |

| Mahabubnagar | B. komuraiaha | 7288899394 |

| Mancherial | S. Srinivas | 7288894048 |

| Medak | K.Aruna | 7288878742 |

| Medchal-Malkajigiri | K.R Ravi Kumar | 7288894185 |

| Nagarkurnool | P.V.Padma | 7288894289 |

| Nalgonda | D.Hussain Babu | 7288894495 |

| Nirmal | A. Veena Reddy | 7288894080 |

| Nizamabad | N. Sreekar | 7288894548 |

| Peddapalli | G. Pratibha Sulaksham | 7207874087 |

| Rajanna Sircilla | Smt. Purnima | 7288894140 |

| Rangareddy | Smt. Sangeetha | 7288894635 |

| Sangareddy | D. Ramya | 7288894442 |

| Siddipet | B. Satganvesh | 7288894415 |

| Suryapet | T. Srinivas | 9440227905 |

| Vikarabad | P. Lavanya | 7995057757 |

| Wanaparthy | M. Ravi Kumar | 7288878434 |

| Warangal (Urban) | N.Sreedhar | 7288878487 |

| Warangal Rural | K. Shreya | 7288894709 |

| Yadadri Bhuvanagiri | P. vanitha | 7288894389 |

TS Rythu Bandhu Life Insurance Bonds Scheme (Earlier Update on 7 August 2018)

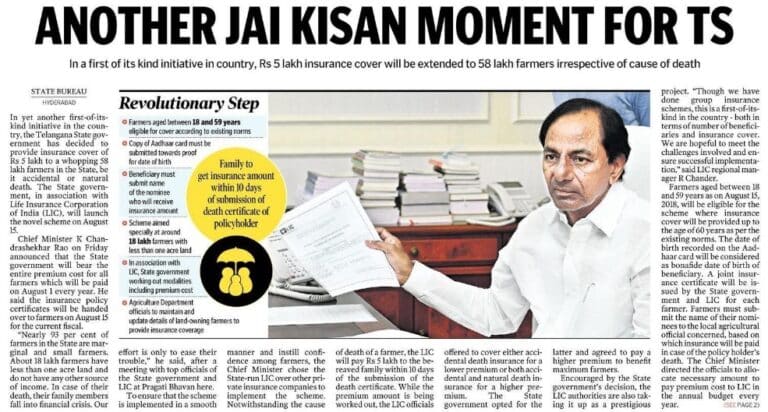

Telangana government has launched Rythu Bandhu Life Insurance Bonds Scheme for farmers. Under this scheme, govt. will provide Rs. 5 lakh insurance to ryots. All the families of farmers covered under Rythu Bandhu Scheme will get this amount irrespective of whether the death is natural or accidental.

All the farmers between the age group of 18 to 60 years can avail benefits of Rythu Bandhu Life Insurance Bonds Scheme. This Life Insurance Scheme will benefit around 28 lakh (2.8 million) farmers out of the total 5.8 million farmers. This is first of its kind initiative across the country and the state govt. has marked the official launch of the scheme on 6 August 2018.

Salient Features of TS Rythu Bandhu Life Insurance Bonds Scheme

The important features and highlights of this TS Rythu Bandhu Life Insurance Scheme are as follows:-

- All land owners who received monetary assistance under the Input / Financial Investment Support Scheme (FISS) are eligible.

- This scheme is limited to farmers falling in the age group of 18 to 60 years.

- The insurance amount in case of either death or accident will be given to the family of farmers in 10 days itself. The state govt. has made an investment of around Rs. 650 crore in Rythu Bandhu Life Insurance Bonds.

- Rythu Bandhu Life Insurance Bonds (as the scheme is called) is expected to benefit 2.8 million farmers (out of 5.8 million).

- Previously under the Rythu Bandhu Scheme, the state govt. has given investment support to bear farming costs to boost agricultural production.

- On 6th August 2018, Agriculture Minister Pocharam Srinivas has distributed the life insurance bonds to farmers in Kamareddy district. Various officials from the agriculture department took up the distribution in other parts of the state.

- The state govt. believes that most of the insurance bonds will be given to the farmers by 15 September.

- Rythu Bandhu Life Insurance Bonds Scheme is continuous as eligible farmers will be added from time to time. Moreover, all those beneficiaries who become ineligible after attaining the age of 60 years will be removed from the list of beneficiaries.

Tenant farmers are consistently demanding to add their names in the list of beneficiaries. But the tenant farmers are not included in this Life Insurance Scheme as well as in Rythu Bandhu Scheme. Such farmers are left out because it is very difficult to identify tenant farmers and that they have no rights over the lands.

Earlier, the state govt. had distributed cheques under Rythu Bandhu programme. This scheme benefited around 5.8 million (58 lakh) land holding farmers and provides assistance to bear farming costs such as purchase of fertilizers and seeds.

Announcement of Telangana New LIC Insurance Scheme (Earlier Update on 29 May 2018)

Telangana govt. is planning to launch a New LIC Insurance Scheme to benefit farmers. Under this scheme, govt. will provide an insurance amount of Rs. 5 lakh on the death of the farmer. The state govt. has announced that life insurance scheme will get launched on 2 June 2018. This scheme will be a Group Insurance Scheme and is applicable for all small, marginal and big farmers.

The state govt. is holding detailed discussions on Insurance Scheme including Central Government scheme to pay farmer’s share / premium amount. This scheme will be absolutely free of cost for the farmers. Govt. is consistently discussing with Life Insurance Corporation (LIC) officers to finalize modalities of scheme.

LIC Life Insurance Scheme for Farmers in Telangana – Rs. 5 Lakh on Death

Life Insurance Corporation (LIC) is already running various schemes for the people across India. These schemes includes LIC’s Jeevan Utkarsh, Jeevan Pragati, Jeevan Labh, Jeevan Anand, Jeevan Rakshak, Jeevan Umang, Anmol Jeevan, Bima Shree and other Term insurance, Money back and Endowment Schemes. So, the state govt. of Telangana wants to start a new Insurance Scheme for all farmers including small, marginal farmers. The important features and highlights of this new LIC Insurance Scheme in Telangana are as follows:-

- In case of death of the farmers, state govt. will provide an insurance amount of Rs. 5,00,000 to the family of farmers.

- Life Insurance Corporation (LIC) will implement this insurance scheme.

- The state govt. will pay the premium on behalf of the farmers.

- Govt. will allocate a budgetary provision for this insurance scheme of farmers. This would be a Group Insurance Scheme.

- This amount will be an assured amount and will be paid directly into the bank account of the farmers.

KCR Mega Health Cum Life Insurance Scheme in Telangana (Earlier Update on 1 March 2018)

Telangana govt. has announced KCR Mega Health Cum Life Insurance Scheme for Ryots. Subsequently, the state govt. will provide an insurance cover of Rs. 5 lakh p.a for health-care and hospitalization and even in the case of death. Accordingly, KCR govt. is going to allocate Rs. 500 crore in Telangana Budget 2018-2019 for successful implementation of this health-cum-life insurance scheme. Moreover, this scheme will benefit around 70 lakh small and marginal farmers in the state.

Under Mega Health Cum Life Insurance Scheme, govt. will provide the insurance amount to the families of farmers in case of accidental death or death due to any natural cause. Farmers will not have to pay any premium for this insurance coverage. Telangana state govt. will bear the entire premium amount for the benefit of farmers. KCR announced this pro-farmer initiative in response to a farmer seeking insurance in Regional Conference of Mandal Level Farmers Coordination Committee.

Telangana Mega Health Cum Life Insurance Scheme Application Forms

Similar to other schemes, farmers have to fill the application forms to avail the benefits of this Mega Health Cum Life Insurance Scheme. Accordingly, KCR govt. will soon send the insurance application forms to the villages. Henceforth, FCC members will ensure that each and every farmer in rural areas fills this Insurance Form. FCC members are given the responsibility to provide insurance facilities to all ryots. Moreover, for the welfare of farmers, govt. is also going to start Input Assistance Scheme / Farmers Investment Support Scheme (FISS) to provide financial assistance of Rs. 4000 per acre for Yasangi and Kharif crops.

Moreover, FISS Scheme is not for tenant farmers as the rules of Tenant Act are very strict. As per the rules in Tenant Act, tenant farmers are not actual farmers rather other farmers cultivate their land. Accordingly, around 97% of farmers in the state cultivates their land on their own instead of giving it on rent to other. Moreover, all types of orchards and non-tribal cultivating land are eligible for financial assistance under FISS Scheme. Henceforth, FISS scheme will protect the interest of land owners with total outlay of Rs. 12000 crore.

For more details, visit the official website at http://rythubandhu.telangana.gov.in/

from सरकारी योजना

via

0 टिप्पणियाँ