Pradhan Mantri Fasal Bima Yojana 2021 online applications or registration can be submitted online through the official website of PMFBY at pmfby.gov.in. Under PMFBY, one of the many schemes launched by Narendra Modi government, farmers can apply online for crop insurance cover and get financial assistance in case their crops gets damaged due to heavy rain, natural calamities, pests or diseases. Interested farmers can also calculate PMFBY insurance premium amount through the same portal.

Govt. is implementing this Pradhan Mantri Fasal Bima Yojana (PMFBY) across the country for the welfare of the farmers. The premium amount under the PMFBY scheme is set to 2% for Kharif and 1.5% for Rabi crops compared to much higher premium under the previous crop insurance. PM Narendra Modi had launched this agricultural insurance / crop insurance scheme on 18 February 2016.

The registration lines for crop insurance for PMFBY 2021 are open and all the interested farmers can apply online for agriculture insurance at the official website of PM Fasal Bima Yojana at pmfby.gov.in.

PM Fasal Bima Yojana Application Form 2021

Application forms for Pradhan Mantri Fasal Bima Yojana can be submitted online or offline through the official portal or through banks / CSC centers respectively. All the nationalized commercial banks, co-operative banks and regional rural banks are authorized for registrations of farmers under PMFBY.

Who Can Apply Online for PMFBY: Online the farmers who have not availed any loan through Kisan Credit Card are eligible to apply online for PMFBY. Since the crop insurance is mandatory for farmers who chose to avail seasonal crop loan through Kisan Credit card, they can apply for PMFBY only through the banks.

How to Apply Online for PMFBY

Below is the complete procedure of how to apply online for agriculture insurance under PMFBY 2021. Online applications for PMFBY can be made through the official portal either using a smartphone or desktop / laptop device.

STEP 1: Visit the official PMFBY portal at pmfby.gov.in

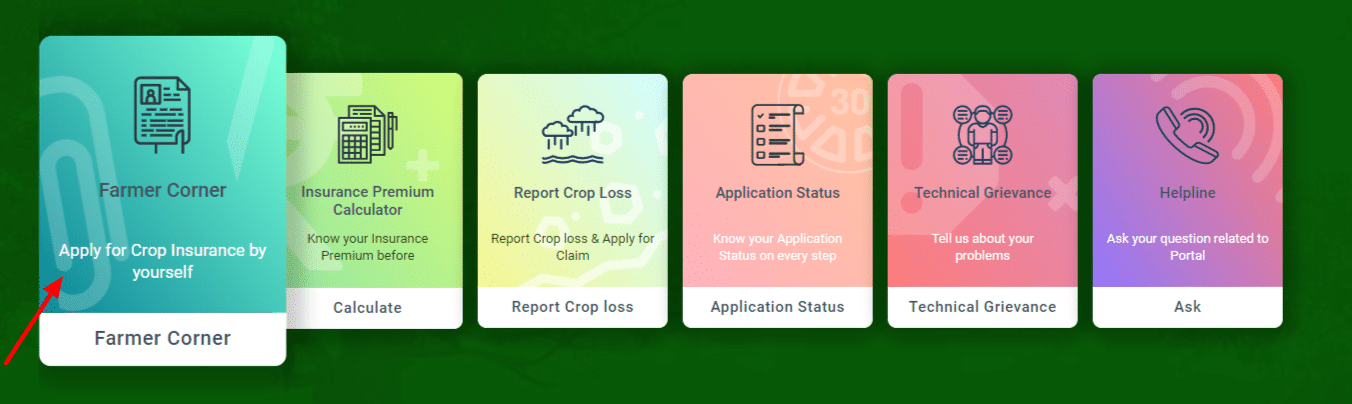

STEP 2: On the homepage, click at the “Farmer Corner – Apply for Crop Insurance by Yourself” section as shown in the figure below:

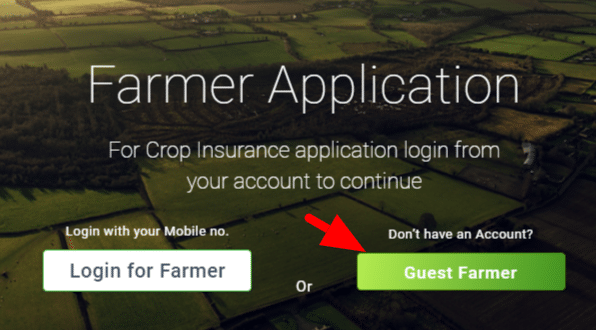

STEP 3: On clicking at the farmers corner, create a new user account by clicking at the “Guest Farmers” tab to open PMFBY crop insurance registration form for new farmers or directly click this link.

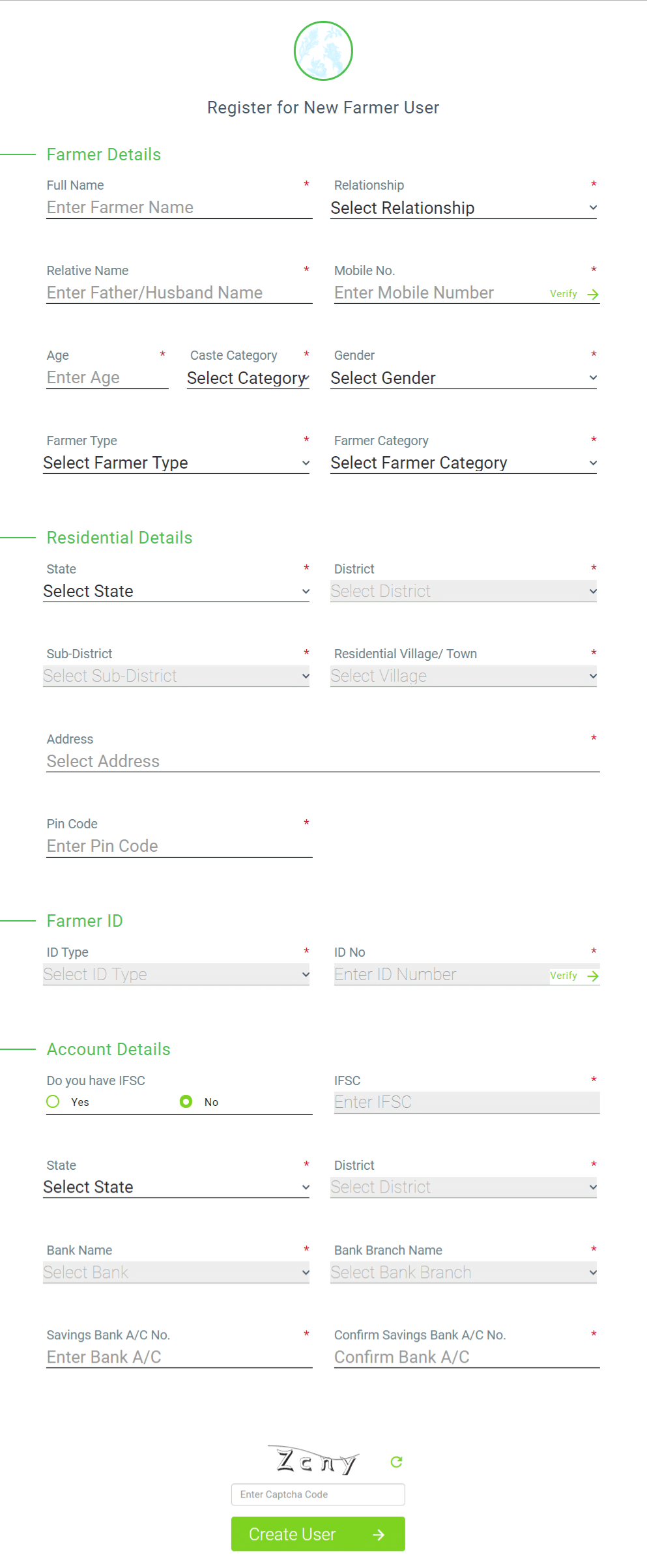

STEP 4: Pradhan Mantri Fasal Bima Yojana online application form for the year 2020 will appear as follows:

STEP 5: Enter farmers details such as name and mobile number (Also Verify mobile number), residential details, farmer ID (Aadhar number to be verified), bank account number and details & click at the “Create User” button to complete the registration process.

STEP 6: After making registration, farmers can Login using their registered mobile number to fill the remaining form for crop insurance, upload the required documents and complete the online application process.

PMFBY List of Documents

Following is the complete list of documents required for crop insurance under PMFBY.

- Aadhar Card

- Bank Passbook (Bank Account Details), Bhoo-Abhilekh, Sowing Certificate

- If you are the land owner, Khasra Number / Khaata Number document is required.

- Sowing certificate can be a simple white paper with details of sowing signed by Patwari, Sarpanch or Pradhan of the village. The procedure is different for different states, contact your nearest bank branch for this.

- If you are the sharing-basis farmer, then a copy of agreement with the land owner with Khasra Number / Khaata Number mentioned on it will be required for registration.

Eligibility Criteria for PM Fasal Bima Yojana

All the farmers across the country who are involved in notified crops production as land owners, tenants or sharing-basis in the notified areas are eligible to apply for the scheme.

All the farmers must apply and pay the insurance premium in order to avail PMFBY scheme benefits or claim the insurance amount.

PMFBY Premium Amount and Premium Calculator

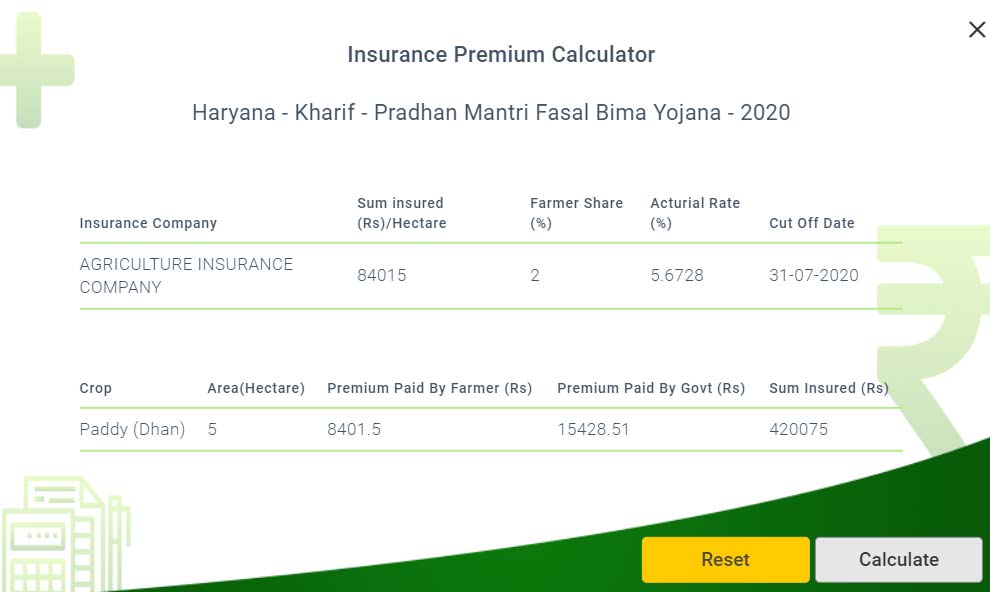

Before making online registrations / applications, farmers must learn how to calculate PMFBY insurance premium amount using PMFBY insurance premium calculator. PMFBY insurance premium calculation is based on the state / district / type of crop and the covered area. The premium to be paid by the farmers for getting crop insurance under PMFBY can be calculated by filling these details on the official portal.

This Crop Insurance Scheme provides financial assistance in case their crops gets damaged due to heavy rain, natural calamities, pests or diseases. Interested farmers can now know premium amount for Kharif or Rabi crop season using the PMFBY premium calculator. The insurance premium under the Pradhan Mantri Fasal Bima Yojana is much less than any other crop insurance scheme. Below is the complete list of PMFBY premium amount to be paid by the farmer.

| For Kharif Crops | 2% of the eligible insured amount |

| For Rabi Crops | 1.5% of the eligible insured amount |

| Annual Commercial and Horticulture Crops | 5% of the eligible insured amount |

The actual insurance premium amount in Rupees can be calculated using the PMFBY insurance premium calculator based on the state / district / crop etc. Below is the complete procedure to calculate PMFBY insurance premium amount:

STEP 1: Visit the PMFBY official portal at pmfby.gov.in

STEP 2: On the homepage, click at the “Insurance Premium Calculator – Know Your Insurance Premium Before” tab:-

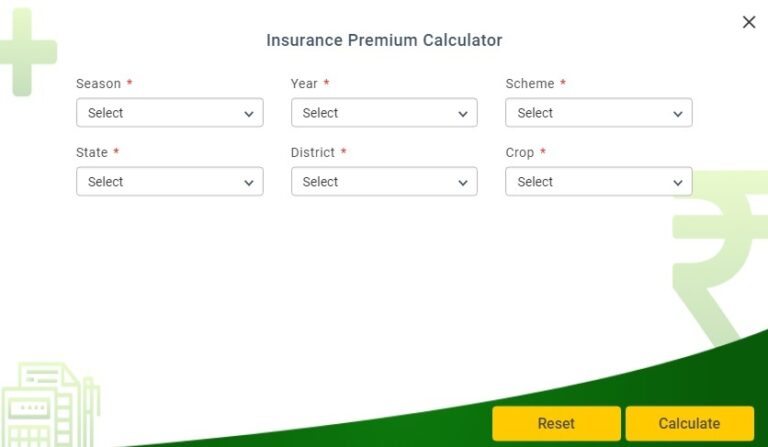

STEP 3: Now the Crop Insurance Premium Calculator Page will open. Representative Image is shown below:

STEP 4: Here enter the details to calculate premium amount. Firstly select the Season (Kharif / Rabi), Year, Scheme Name (PMFBY, Weather Based Crop Insurance), State, District, Crop and then Area in hectares.

STEP 5: Finally, click at the “Calculate” button to Know Your Insurance Premium Amount. The calculated insurance premium for Pradhan Mantri Fasal Bima Yojana based on your selections will be displayed as below:

Check PM Fasal Bima Yojana Application Status Online

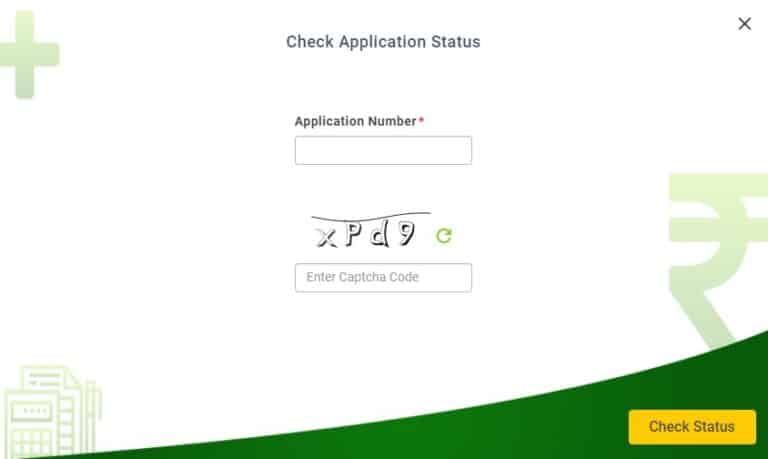

Below is the complete procedure to check PMFBY farmer online application status:

STEP 1: Firstly visit the official PMFBY portal at pmfby.gov.in

STEP 2: At the homepage, click at the “Application Status – Know Your Application Status on every Step” link as shown in the figure:-

STEP 3: Afterwards, PMFBY farmer online application status form will appear as follows:-

STEP 4: Here candidates can enter the “Application Number” and “Captcha” and then click at the “Check Status” button to view the PMFBY farmer application status.

PMFBY status can easily be checked by clicking the “Application Status” banner on the homepage and the entering the receipt number in the input box.

Download Pradhan Mantri Fasal Bima Yojana App

Official Pradhan Mantri Fasal Bima Yojana Android app latest version can be downloaded from the below URL on Google Play Store

https://play.google.com/store/apps/details?id=in.farmguide.farmerapp.central

You can also directly open the Play Store App on your android mobile and type “Crop Insurance” in the search box to find and then download PMFBY app.

Screenshots of PMFBY App

Features of PMFBY App

- Farmers can register on the app using their Name and Phone Number to view details about their crop insurance.

- Farmers can calculate the premium amount based on the set preferences such as notified area.

- Details about the sum insured can also be viewed on the Fasal Bima App after registration.

PMFBY Last Date for Online Application

Last date for applications for Pradhan Mantri Fasal Bima Yojana is as following

For Rabi Crops: 31st December

For Kharif Crops: 31st July

However, actual last date of PMFBY application can be obtained from the official portal / nearest CSC center / insurance company or the agriculture officer or the banks in your area.

How to Claim Insurance Amount Under PMFBY

Below is the complete procedure to report the loss of crops and claim the insurance amount from the insurance company.

- At first, the farmers have to inform the insurance company, bank, concerned state government officer, or at the toll free number of insurance company within 72 hours of the loss / damage of corps.

- Bank / concerned state government officer will forward the information to the insurance company.

- The insurance company will appoint damage surveyor within next 72 hours.

- The survey of the damage of crops will be done within next 10 days.

- Payment of insured amount will be received within 15 days after the completion of survey.

Toll free numbers of PMFBY insurance companies

| Insurance Company Name | Toll Free Number |

|---|---|

| Agriculture Insurance Company | 1800116515 |

| Bajaj Allianz General Insurance Co. Ltd. | 18002095959 |

| Bharti Axa General Insurance Co. Ltd. | 18001037712 |

| Cholamandalam MD General Insurance Co. Ltd. | 18002005544 |

| Future Generali India Insurance Co. Ltd. | 18002664141 |

| HDFC ERGO General Insurance Co. Ltd. | 18002660700 |

| ICICI Lombard General Insurance Co. Ltd. | 18002669725 |

| IFFCO Tokio General Insurance Co. Ltd. | 1800-103-5490 |

| National Insurance Co. Ltd. | 18002007710 |

| New India Assurance Company | 18002091415 |

| Oriental Insurance | 1800118485 |

| Reliance General Insurance Co. Ltd. | 18001024088/180030024088 |

| Royal Sundaram General Insurance Co. Ltd. | 18005689999 |

| SBI General Insurance | 18001232310 |

| Shriram General Insurance Co. Ltd. | 180030030000/18001033009 |

| TATA AIG General Insurance Co. Ltd. | 18002093536 |

| United India Insurance Co. | 180042533333 |

| Universal Sompo General Insurance Company | 18002005142 |

PMFBY Benefits and Salient Features

PMFBY benefits includes Investment Protection and Yield Protection as two main benefits. Below are some of the salient features of PM Fasal Bima Yojana.

- Very Less Premium Amount

- Complete insured amount in case of loss of crops due to natural calamity.

- Make the agriculture more beneficial.

- Promote the development of farmers and agriculture in India.

- Easy Online application and claim procedure.

- Online insurance premium calculator.

- 24×7 helpline at help.agri-insurance@gov.in

PMFBY Guidelines PDF

The detailed revised guidelines of Pradhan Mantri Fasal Bima Yojana can be downloaded in PDF format using the below given links.

PMFBY Guidelines – Revised (English): https://pmfby.gov.in/pdf/Revised_Operational_Guidelines.pdf

PMFBY Guidelines – Revised (Hindi): https://pmfby.gov.in/pdf/Revised_Operational_Guidelines_Hindi.pdf

Other documents including the older PMFBY guidelines can be downloaded from this link.

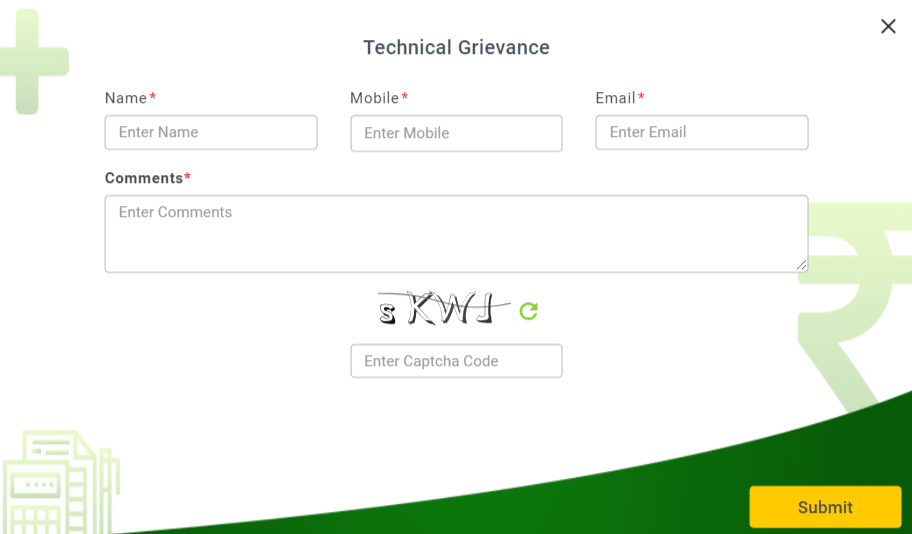

PMFBY 2021 Complaint / Grievance Section

For the convenience of farmers, Govt. has also provided the Technical Grievance facility for any technical issue. Now farmers can submit any technical issue directly to the concerned authorities. For this, farmers needs to click at the “Complaints – Tell Us About Your Problems” section to open the complaint registration form.

Fill all the details in the complaint form and hit the “Submit” button to send your complaint.

PMFBY Helpline

For any query, farmers can directly call the toll free numbers of insurance companies or at 011-23382012 followed by extension no. 2715/2709. People can also call on the direct helpline number 011-23381092. For any query about PMFBY, farmers write their queries at help.agri-insurance@gov.in

PM Fasal Bima Yojana – FAQ’s

✔️ What is Pradhan Mantri Fasal Bima Yojana

Pradhan Mantri Fasal Bima Yojana or PMFBY is a crop insurance scheme for farmers being run by Central Government across India

✔️ What is the last date of application under PMFBY

Every Year 31st July is the last date for Kharif crops and 31st December is the last date for Rabi crops

✔️ How to Apply for PMFBY

Farmers can apply online or offline for the crop insurance under PMFBY

✔️ How to Apply Online for PMFBY

Farmers can apply online for Pradhan Mantri Fasal Bima Yojana through the official portal of the scheme at pmfby.gov.in

✔️ How to Apply Offline for PMFBY

Offline applications can be done through the bank branches / common service centers across the country.

✔️ What is the premium amount to be paid by the farmers under PMFBY

Farmers have to par 2% of the insured amount, Kharif crops and 1.5% for Rabi crops and 5% of the insured amount for the commercial annual crops and gardening crops

✔️ Who can apply for PMFBY

Any farmer who is a land owner or tenant or sharing-basis can apply for crop insurance under PMFBY

✔️ How to Claim the Insured Amount under PMFBY

The PMFBY claim procedure is very easy, farmers who have taken the crop insurance just have to call the toll free number of the insurance company or inform the bank / concerned agriculture officer within 72 hours of the crop loss or damage.

✔️ In how may days the insured amount will be paid

After the survey of damaged crops is complete, insured amount will be transferred to the bank account of farmer within 15 days.

✔️ How to calculate the PMFBY insurance premium amount

Farmers can use the PMFBY insurance premium calculator on the official portal to calculate the same on the basis of state / district / crop and area.

For more details about PMFBY, visit the official website https://pmfby.gov.in

from सरकारी योजना

via

0 टिप्पणियाँ