Central Government has launched Swarnajayanti Gram Swarozgar Yojana (SGSY) to provide sustainable income to rural and urban poor. PM Atal Bihar Vajpayee had launched this scheme on 1 April 1999. SGSY Scheme will provide self employment opportunities through the establishment of Self Help Groups (SHGs). This scheme has resulted in the establishment of 22.5 lakh SHGs to benefit 66.97 lakh people. All the candidates can check details at sgsy.gov.in (website now closed) as Swarnajayanti Gram Swarozgar Yojana has now been restructured as National Rural Livelihood Mission (DAY-NRLM) and later renamed as Aajeevika Mission.

SGSY Scheme subsumes the previous 6 schemes – Integrated Rural Development Programme (IRDP), Training of Rural Youth for Self Employment (TRYSEM), Development of Women & Children in Rural Areas (DWCRA), Supply of Improved Toolkits to Rural Artisans (SITRA), Ganga Kalyan Yojana (GKY) and Million Wells Scheme (MWS).

Under this rural employment scheme, govt. will establish Activity clusters on the basis of aptitude and skill of the people. NGOs, Panchayat Raj Institutions, District Rural Development Agencies (DRDAs), Technical Institutions, Banks and other Financial Institutions will provide funds. This scheme is now renamed as National Rural Livelihood Mission (NRLM) & then renamed as Aajeevika Mission.

Swarnajayanti Gram Swarozgar Yojana – SGSY Objectives

SGSY Scheme details are present at official website sgsy.gov.in. The objectives of SGSY are as follows:-

- To alleviate poverty by setting up a large number of Micro enterprises in rural areas across the country.

- Capitalization of Group Lending.

- An Overall programme of micro enterprises which covers every aspect of self employment including organization of rural poor into Self Help Groups.

- Integration of several agencies like District Rural Development Agencies, Banks, Line Departments, Panchayati Raj Instituions, NGOs etc.

- To provide mix income generating assets like Bank Credit + Govt. Subsidy.

Download SGSY Online Application Form

All the candidates can download the SGSY Scheme Online Application through the link given below:-

- SGSY Online Application Download – https://ift.tt/3ePJP5N (link not functional now), till then check details at http://megcnrd.gov.in/forms/SGSY.pdf

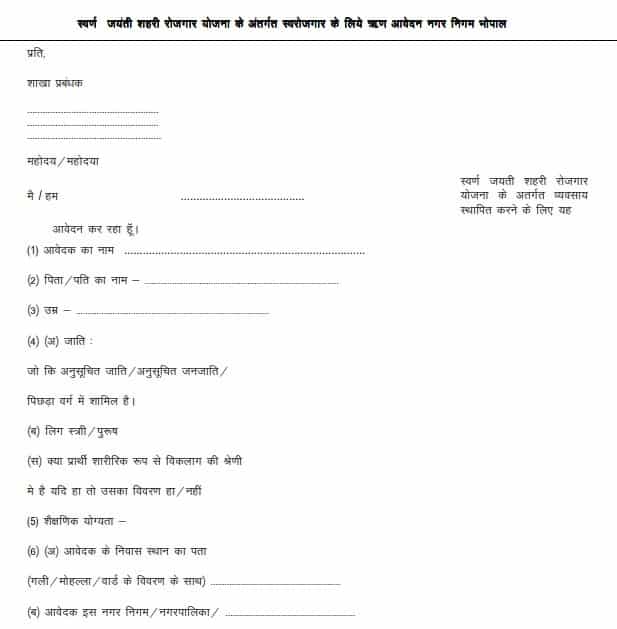

- The MP SGSY Scheme application form will appear as follows:-

People can fill this Swarnjayanti Gram Swarozgar Yojana Application Form and submit it to the concerned authorities to apply for this scheme.

SGSY Scheme Benefits

All the people can check the benefits of Swarnajayanti Gram Swarozgar Yojana in the SGSY Scheme PDF. We are providing you the basic info. on Scheme components and their benefits:-

- Skill Upgradation

- Activity Clusters, Self – Help Groups (SHGs)

- Revolving Fund

- Lending Norms

- Assistance to IRDP borrowers

- Insurance Cover

- Security norms

- Subsidy & Post Credit follow up

- Risk Fund for consumption credit

- At-least 5 years duration of Repayment of loan

- Prompt Recovery of Loans

- Refinance of SGSY loans

- Deputation of Bank Officials to the DRDAs

- Service Area Approach

- Submission of data & Annual Credit Plan

- LBR Returns

For complete details of all these components, please click the link – SGSY Scheme PDF

Swarnajayanti Gram Swarozgar Yojana (SGSY) Features – Quick Facts

The important features and highlights of this scheme are as follows:-

| Scheme Name | Swarnajayanti Gram Swarozgar Yojana (SGSY) |

| Who Launches SGSY | PM Atal Bihari Vajpayee |

| Launch Date | 1 April 1999 |

| Objective | To Provide Training, Credit, Technology, Infrastructure, Marketing and help Poor People by organizing them as Self Help Groups (SHGs). This is done through capacity building and income generation provisions for Below Poverty Line (BPL) People. |

| Beneficiaries | All the families whose name appears in the All India Final Below Poverty Line (BPL) List identified through SECC Data and approved by Gram Sabha will be the eligible beneficiaries. |

| Funds / Insurance | Maximum limit of Rs. 1.25 lakhs or Rs. 10,000 per person. |

| Target | To bring out at-least 30% poor families above the poverty line. SGSY will focus on vulnerable section of the rural poor. Accordingly the SC/ST will account for at least 50%, Women 40% and the disabled 3% of those assisted. |

| Premium Dividend | 75% share of Central Govt. and 25% share of State Level Govt. |

| Loan Payment Term | First is 5 years, Second is 7 years and Tertiary is 9 Years. |

| Banks | Commercial Banks, Co-operative Banks & Regional Rural Banks |

| Official Website | www.sgsy.gov.in |

The main motive is to bring poor people above the poverty line. Utilization of Money though Income Generation Programme. To provide Bank Loans and Govt. Subsidy and to ensure at-least Rs. 2000/- per month to poor people. For more details, visit the official website – http://sgsy.gov.in/

History

The initial scheme Swarnajayanti Gram Swarozgar Yojana (SGSY) was launched in 1999. It was renamed as National Rural Livelihood Mission in 2011. Finally they were merged into DDU-AY.

The SGSY was somewhat intended to provide self-employment to millions of villagers. The programme aims at bringing the assisted poor families above the poverty line by organising them into self-help groups (SHGs) through a mix of bank credit and government subsidy. The main aim of these SHGs was to bring these poor families above the poverty line and concentrate on income generation through combined effort. The Swarna Jayanti Swarozgar Yojna (SGSY) has been renamed as National Rural Livelihood Mission (NRLM). With this the scheme will be made universal, more focussed and time bound for poverty alleviation by 2014.

Purpose

“Extended to all the 4,042 statutory cities and towns of the country, DAY-NULM aims at reducing urban poverty by improving livelihood opportunities through skill training and skill upgradation for self-employment, subsidised bank loans for setting up micro-enterprises, organising urban poor into self-help groups, among others.”

For complete list of DAY-NRLM / Aajeevika Mission Schemes – Click Here

from सरकारी योजना

via

0 टिप्पणियाँ