SBI PMAY Home Loan Yojana 2021 apply online form at homeloans.sbi/pmay: Pradhan Mantri Home Loan Yojana or the credit linked subsidy scheme under the Pradhan Mantri Awas Yojana – Urban (PMAY-U) offers interest subsidy on home loans. India’s largest public sector bank, State Bank of India is inviting online applications for home loan under Pradhan Mantri Awas Yojana. The interested / eligible candidates can apply online for PMAY home loan scheme through SBI home loans official website and avail interest subsidy.

Like other banks, State Bank of India is offering interest subsidy on the home loans under the four different categories namely CLSS – EWS / LIG (15 Years Tenure), Revised CLSS – EWS/LIG (20 Years Tenure), CLSS (MIG-I) and CLSS (MIG-II). The subsidy on home loan under the PMAY can be availed by the eligible candidates for acquisition or construction of first home.

The CLSS scheme for eligible EWS and LIG candidates is open till 31st March 2022 while MIG candidates can apply for the interest subsidy under the CLSS scheme till 31st March 2021.

SBI PMAY Home Loan Yojana Online Application Form 2021

Below is the complete step by step procedure to fill SBI home loan application form under the CLSS component of PM Awas Yojana – Urban. But before you apply for the home loan scheme, do check your eligibility for the scheme.

STEP 1: Visit the official website of SBI Home Loans at https://homeloans.sbi/pmay

STEP 2: Read the complete eligibility criteria and scheme details by scrolling below on the page.

STEP 3: Once you find yourself eligible for the CLSS scheme, click on the “Apply Now” button on the top of the page or directly click this link. After clicking this link a page as shown below will open.

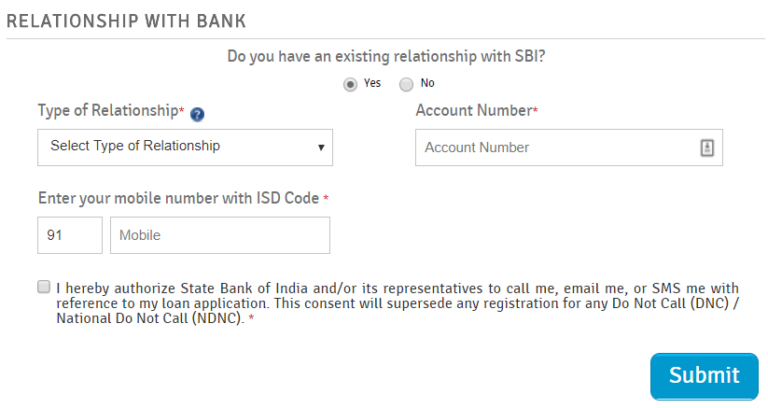

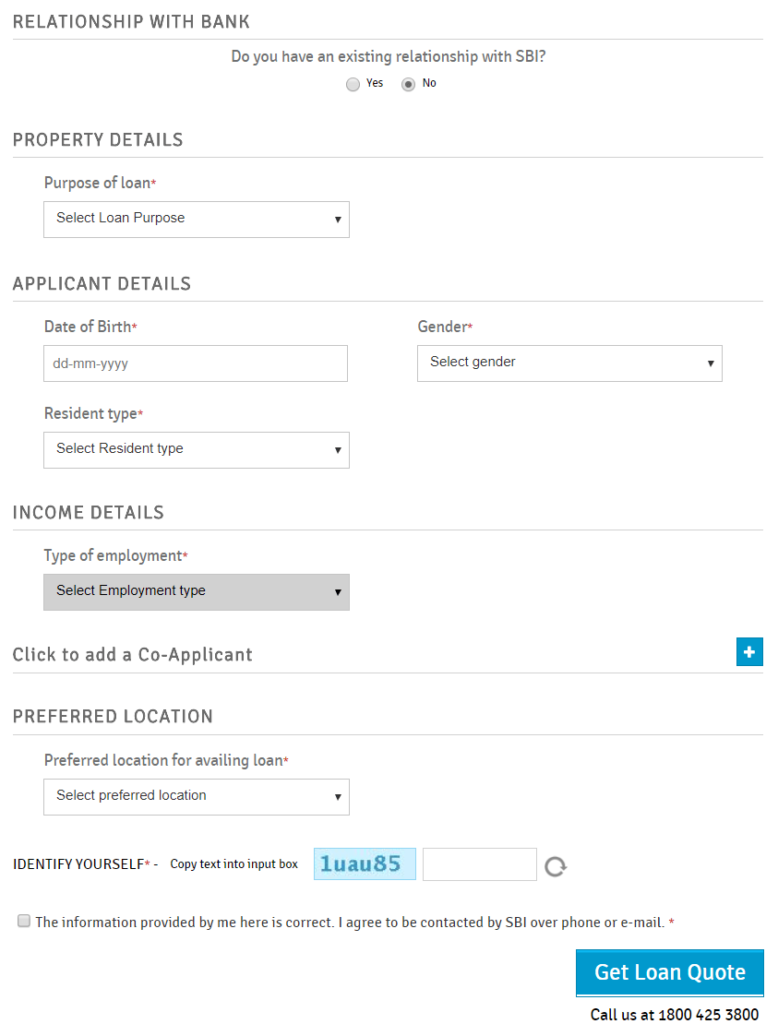

STEP 4: In this page, select your relationship with the bank, i.e. if you are already a customer of SBI, then select “Yes” and choose the type of relationship and enter your account number and phone number. Else, select “No” fill all the required details such as purpose of loan, applicant’s details, income details, co-applicant details, and preferred location.

STEP 5: Once you select “Purpose of Loan” and other options in the form, you will be asked a few more details about the property you are planning to buy / construct on / extend. Fill all the required details and complete the form as shown below.

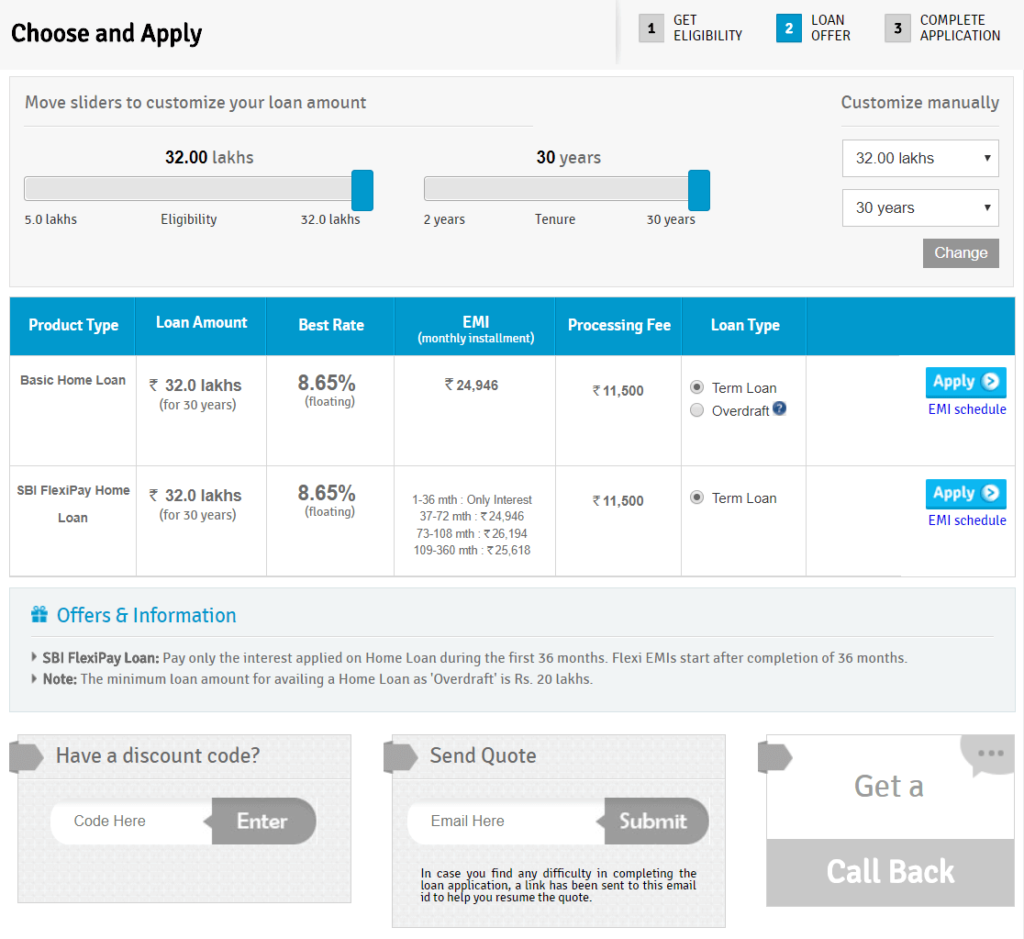

STEP 6: Once you click “Get Loan Quote” button, you will be shown loan offers on the next page based on your eligibility / income details. The loan offers page will be displayed as shown below. EMI, tenure, interest rate, and loan type information will be displayed on this page.

If SBI finds you not eligible for the loan, it will not display any offers, in this case you may be required to contact the SBI branch itself.

STEP 7: Now you can adjust your loan amount and tenure from here and click on “Apply” button against the loan offers as per your choice. Once you click apply button, you will be asked to verify your mobile number and e-mail ID. Enter a valid mobile number and e-mail ID and click verify button. Then enter the OTP received on your mobile number and the captcha image and click “Confirm” button. You will also receive the home loan offer details on your e-mail ID.

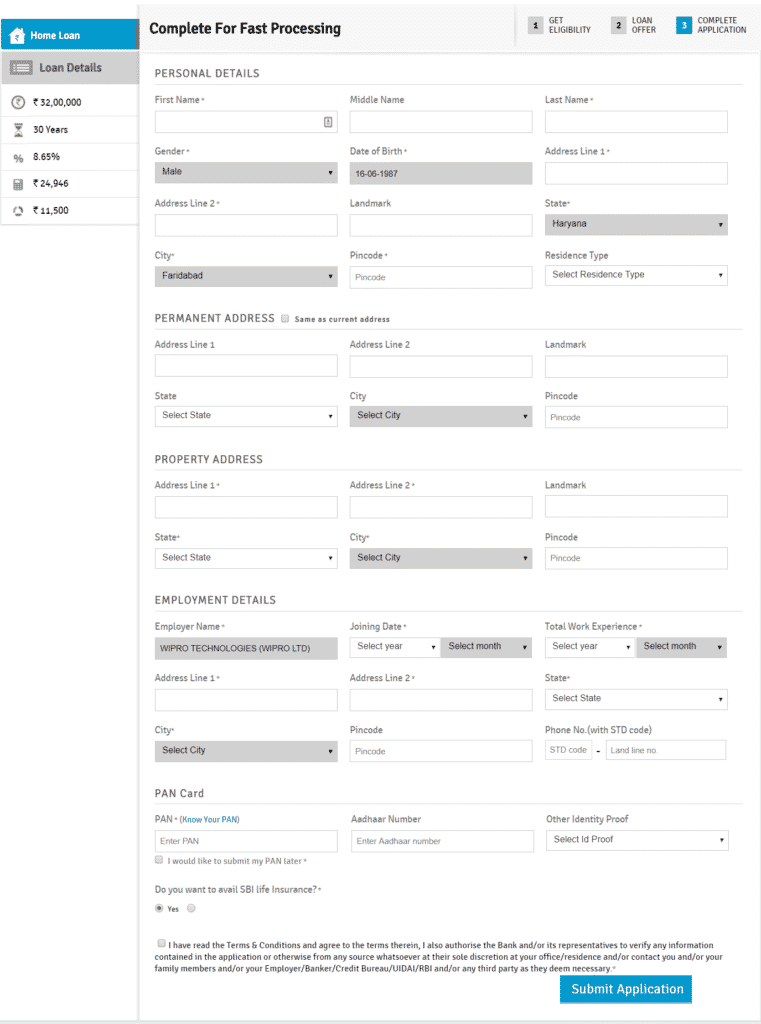

STEP 8: Once your mobile number is confirmed, you will be asked to fill the home loan online application form as shown below. Fill all the required details in the application form and click “Submit Application” button at the bottom of the page.

After filling and submitting the application form, you will receive an acknowledgement / reference / application number to track the status of your loan. Keep note of it for future reference.

PMAY Home Loan Yojana Eligibility & Guidelines

CLSS for EWS & LIG

| Criteria | Existing Instructions (CLSS – EWS + LIG) | Revised Instructions (CLSS – EWS + LIG) |

|---|---|---|

| Household/ Annual Income (Rs) | Upto Rs. 6 lakhs | Upto Rs. 6 lakhs |

| Property Area (Carpet Area) | 30 sqm for EWS and 60 sqm for LIG | 30 sqm for EWS and 60 sqm for LIG |

| Location | 17778 towns | 17778 towns |

| Woman Ownership | Yes (except for construction) | Yes (except for construction) |

| Max Loan Amt for Subsidy | Upto 6 lakhs | Upto 6 lakhs |

| Subsidy % | 6.50% | 6.50% |

| Subsidy Amount | Rs. 2.20 lakhs | Rs. 2.67 lakhs |

| NPV | 9% | 9% |

| Max term of loan (on which subsidy will be calculated) | 15 yrs | 20 yrs |

| Property should be Family’s | 1st home** | 1st home** |

| Validity | 2022 | 2022 |

| Applicability | Loans approved on/after 17/06/2015 | Loans approved on/after 01/01/2017 |

CLSS for MIG-I and MIG-II

| Criteria | CLSS (MIG 1) | CLSS (MIG 2) |

|---|---|---|

| Household/ Annual Income (Rs) | Rs. 6.01-12.00 lakhs | Rs. 12.01-18.00 lakhs |

| Property Area (Carpet Area) | 120 sqm | 150 sqm |

| Location | Urban – 2011 | Urban – 2011 |

| Woman Ownership | Not Required | Not Required |

| Max Loan Amt for Subsidy | Upto 9 lakhs | Upto 12 lakhs |

| Subsidy % | 4% | 3% |

| Subsidy Amount | Rs. 2.35 lakhs | Rs. 2.30 lakhs |

| NPV | 9% | 9% |

| Max term of loan (on which subsidy will be calculated) | 20 yrs | 20 yrs |

| Property should be Family’s | 1st home** | 1st home** |

| Validity | 31/03/2020 | 31/03/2020 |

| Applicability | Loans approved on/after 01/01/2017 | Loans approved on/after 01/01/2017 |

PMAY List of Cities / Towns

There are a total of about 17778 cities and towns across the country where the benefits of PMAY home loan scheme can be availed. The PMAY list of cities can be downloaded directly from the link from the SBI website.

PMAY List of Banks for Home Loans

There are hundreds of banks and housing finance companies which are providing home loans under the PMAY-U CLSS component. The list of all the banks can be accessed from the below URL.

List of PMAY Home Loan Banks & Housing Finance Companies Under CLSS for EWS/LIG

List of PMAY Home Loan Banks & HFC’s for MIG

For more details about the SBI PMAY home loan application form and procedure, please visit this link or contact any nearest bank branch.

from सरकारी योजना

via

0 टिप्पणियाँ