Central government has launched Atal Pension Yojana 2021 (previously Swavalamban Yojana) as a government backed pension scheme for unorganized sector. Under this scheme, all the subscribers get minimum monthly pension of Rs. 1,000 to Rs. 5,000 per month after retirement. Elderly people above 60 years of age can see APY Subscribers Contribution Chart, Statement and use APY Calculator to review their pension amount. Interested candidates can fill Atal Pension Yojana Online Form at enps.nsdl.com

Atal Pension Yojana – अटल पेंशन योजना

Under the Atal Pension Yojana, Central govt. contributes 50% of the subscriber’s contribution or Rs. 1000 per annum (whichever is lower) for 5 years. Govt. contribution is restricted only for those people who are non-income tax payers and are also not covered under Statutory Social Security Scheme. All the bank account holders can apply for this APY Scheme and get guaranteed minimum pension from govt. of India. Atal Pension Yojana is one of the Jan Suraksha Schemes launched by NDA Government which aims to create social security at old age.

Now APY subscribers contribution amount can be changed anytime during a year w.e.f 1 July 2020. Earlier the subscriber was allowed to make change only in the month of April. Check details in the section later. From 1 July 2020, banks has restarted auto-debiting contributions from the accounts of Atal Pension Yojana (APY) subscribers.

Atal Pension Yojana Apply Online

Below is the complete procedure online subscriber application and fill Atal Pension Yojana form online:-

STEP 1: Firstly visit the official website enps.nsdl.com

STEP 2: On the homepage, click “Registration” button or directly click this link to open the Atal Pension Yojana Online Subscriber Registration Form as shown below:

STEP 3: Here enter your Aadhaar Number and generate OTP on your registered mobile number. After entering OTP, click “Continue” button.

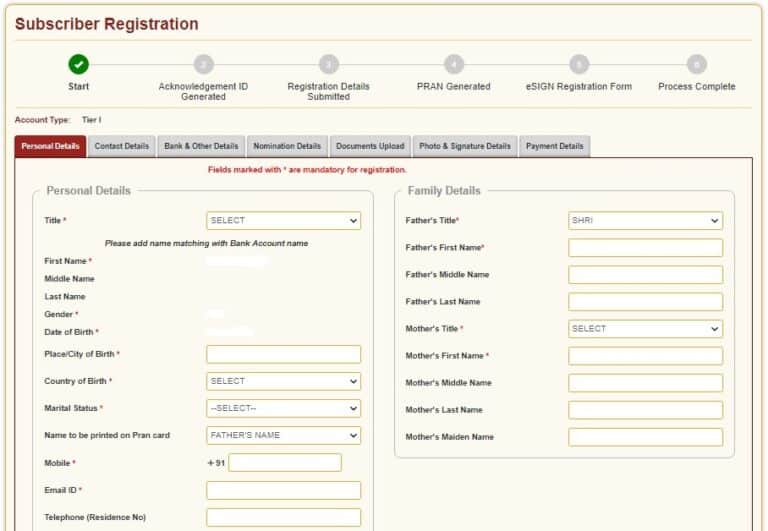

STEP 4: Afterwards, Atal Pension Yojana Online Application Form will appear as shown below:-

STEP 5: Now provide personal details, family details and generate acknowledgement number. After acknowledgement Id is generated, enter bank / branch details & account number for bank verification.

STEP 6: Next fill the pension amount, contribution frequency, nominee and upload the supporting documents and make payment to complete the atal pension yojana online registration process.

If the registration process is successful, then bank will debit your account for 1st subscription and will generate Permanent Retirement Account Number (PRAN).

APY Subscriber Application Forms PDF

You can also apply for Atal Pension Yojana through any bank by simply filling and submitting the physical application form. You can download the Atal Pension Yojana application form PDF using the below link.

APY Subscriber Registration Form: https://npscra.nsdl.co.in/nsdl/forms/APY_Subscriber_Registration_Form.pdf

APY Subscriber Registration Form for Swavalamban Yojana Subscribers: https://npscra.nsdl.co.in/nsdl/forms/APY_Subscriber_Registration_Form_Swavalamban_Yojana_Subscribers.pdf

Eligibility Criteria for Atal Pension Yojana

The candidates must fulfill the following eligibility criteria to avail Atal Pension Yojana Benefits:-

- All the subscribers must be an Indian Citizen

- Applicants must lie between 18 to 40 years of age.

- The minimum contribution period for APY is 20 years after which govt. of India will provide guaranteed minimum pension.

- Aadhaar and Mobile number are essentially recommended documents for KYC of beneficiary, spouse and nominee. Moreover for address proof candidates can submit ration card or bank passbook.

- To participate in the scheme, the applicant should have a saving bank account and should not be a member of any statutory social security scheme.

- All the existing members of Swavalamban Yojana NPS Lite which did not gain much popularity has automatically been migrated to Atal Pension Yojana.

- The applicant should not be a tax-payer to the country.

All the candidates can opt for monthly pension between Rs. 1000 to Rs. 5000 and ensure regular monthly contribution. In addition to this, people can also opt to increase or decrease their pension amount anytime in a year (earlier in the month of April). Moreover, GoI will link this scheme with PM Jan Dhan Yojana Scheme to automatically deduct contribution from bank account.

Atal Pension Yojana Chart / Contribution Calculator

People can see the subscriber contribution chart to know Minimum Guaranteed Pension amount per month as per age of their entry. For monthly pension amount of Rs. 1000 (contribution – Rs. 1.7 lakh), Rs. 2000 (contribution – Rs. 3.4 lakh), Rs. 3000 (contribution – Rs. 5.1 lakh), Rs. 4000 (contribution – Rs. 6.8 lakh) and for Rs. 5000 (contribution – Rs. 8.5 lakh). All the subscribers can see APY Contribution Chart / Atal Pension Yojana Calculator using the link given below:

https://sarkariyojana.com/wp-content/uploads/2019/12/APY_Subscribers_Contribution_Chart.pdf

People can enter APY Scheme at any age between 18 to 40 years and safeguard their future through filling Atal Pension Yojana Online Form.

Atal Pension Yojana Transaction Statement View (e-PRAN)

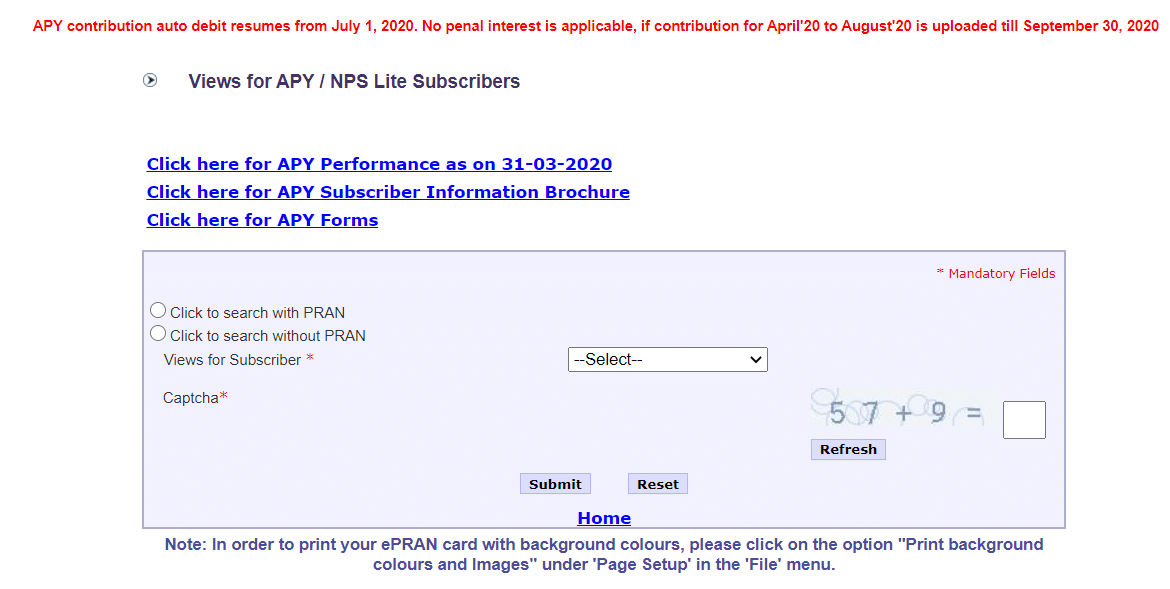

The government has allowed the APY subscribers to view their ePRAN or statement of transaction online on the NSDL website. The facility launched by the Ministry of Finance is aimed improving the service and digitally empower the Atal Pension Yojana subscribers. All the APY subscribers can see the APY Scheme transaction statement with or without PRAN Number.

Subscribers having PRAN number can enter their Bank Account number while subscribers without PRAN have to enter their Name and Date of Birth to view APY statement using the link – Click Here. The page where applicants can check their APY transaction statement will appear as shown below:-

How To Make Atal Pension Yojana Registration at Banks

Here is the complete procedure to make registration for Atal Pension Yojana at banks:-

- All the national banks provide the pension yojana, so, you can visit the bank with which you have your account and register yourself for APY.

- The registration forms are available online as mentioned above, as well as, at the bank branches. You can download the form and submit it at the bank or you can fill and submit it at the bank itself.

- Provide a valid mobile number and attach the photocopy of your Aadhar card.

Once your application is approved, you will receive a confirmation SMS on your registered mobile number.

Progress of Atal Pension Yojana till 1 January 2021

The Atal Pension Yojana (APY), a guaranteed pension scheme offered by the Government of India, has crossed a landmark by reaching a total of 2.75 crore enrolments. It clocked in more than 52 lakh new subscribers during the financial year 2020-21. State Bank of India (SBI) has enrolled more than 15 lakh new APY subscribers, while other banks like Canara Bank, Indian Bank, Central Bank of India, Bank of India, Bank of Baroda, Airtel Payments Bank Ltd, Punjab National Bank, Axis Bank Ltd, Union Bank of India and Indian Overseas Bank have sourced more than 1 lakh APY accounts.

The APY offers triple benefits to the subscribers on attaining 60 years of age. It also includes minimum guaranteed pension to the subscribers, the same guaranteed pension to the spouse after the demise of the subscriber and returns of the accumulated pension wealth as accumulated till age 60 of the subscribers to their nominees.This pension scheme is administered by the Pension Fund Regulatory and Development Authority (PFRDA) through the NPS (National Pension System) architecture.

Penalty on Delayed Contributions by Banks

Usually a penalty is collected by banks for delayed contributions under Atal Pension Yojana. As per the official APY website, these are the penal charges for delayed contributions:-

A) Rs. 1 per month for contribution up to Rs 100 per month.

B) Rs. 2 per month for contribution between Rs 101 and Rs 500.

C) Rs. 5 per month for contribution between Rs 501 and Rs 1,000.

D) Rs. 10 per month for contribution exceeding Rs 1,001.

All the citizens who have joined National Pension Scheme (NPS) are eligible for this APY Scheme. This social security scheme was launched in June 2015. Pension Fund Regulatory and Development Authority (PFRDA) administers APY through NPS architecture. If the monthly contribution is not made of continuous 6 months, the account will be frozen. The account will be deactivated if no payment is made for 12 months or will be closed in case non-payment for 24 months.

The latest PFRDA communication also stated that penal interest will not be charged if the subscriber’s pension scheme account is regularised before September 30, 2020. “Penal interest will not be charged if your non-deducted APY Contributions from April-2020 to August-2020 are regularised along with regular APY contributions before 30th September, 2020.”

Spouse Now Eligible for Atal Pension Yojana

The government has made a very important amendment to the Atal Pension Yojana which now allow spouse to receive the pension benefits in case of premature (before 60 years of age) death of the subscriber. The amendment has been made after receiving feedback from various quarters across the country. The option of handing over the lump-sump amount to the nominee/spouse in case of premature death was not preferred by many. Instead, people want to continue contributing after the death and receive pension benefits after the subscriber would have turned 60 years of age.

In case of death of both subscriber and spouse, the nominee will be entitled to receive the pension wealth, as accumulated till age of 60 years of the subscriber. The spouse will now be able to continue the contribution to the plan for remaining period and receive same pension benefits after the subscriber would have completed 60 years.

In exceptional circumstances, that is, in the event of the death of beneficiary or specified illness, as mentioned in the PFRDA (Exit and withdrawals under the National Pension System) Regulations, 2015, before the age of 60 years, the accumulated pension wealth till date would be given to the nominee or the subscriber as the case may be.

APY Subscribers Contribution Amount Can be Changed Anytime During Year

PFRDA has asked banks to process requests for change in Atal Pension Yojana (APY) subscribers contribution amount anytime during a year. This move aims at making APY Scheme more attractive and the new arrangement has been made available from 1 July 2020. Earlier, subscriber was allowed to make change in contribution amount in the month of April.

The new arrangement will enable subscribers to increase / decrease their pension plans as per their changed income levels and capacity to pay APY contributions. It is very important to continue contribution in the APY Scheme till the age of 60 years. PFRDA has asked “all banks to process upgrade / downgrade of pension amount requests of APY subscribers throughout the year w.e.f 1 July 2020“.

However it is important to note that a subscriber can change pension plan only once in a financial year. There are around 2.28 crore subscribers enrolled under the APY scheme.

Restart of Auto Debit Contributions from APY Account

As you are aware, vide its circular (Ref. No: PFRDA/2020/8/P&D-APY/1) dated 11 April 2020, Pension Fund Regulatory and Development Authority (PFRDA) had instructed Banks to stop auto-debit of APY contribution till 30th June 2020. Accordingly, auto debit for APY contributions has resumed from 1st July 2020.

Tax Benefits of Atal Pension Yojana

Contributions made by an individual under the Atal Pension Yojana are eligible for the deductions under section 80CCD of the Income Tax Act, 1961. Maximum deduction allowed under section 80CCD (1) of the Income Tax Act, 1961 is 10% of gross total income subject to maximum deduction of Rs. 1,50,000 p.a. as specified under section 80CCE of the Income Tax Act.

An additional contribution of Rs. 50,000 p.a. is eligible for an additional deduction of Rs. 50,000 p.a. under section 80CCD(1B) of the Income Tax Act, 1961. These deductions are subject to the fulfillment of the conditions mentioned in the Income Tax Act, 1961. Tax laws are subject to amendments from time to time. This is not a legal advice or tax advice and users are further advised to consult their tax advisors before making any decision or taking any action.

Exiting the Scheme

Once enrolled, the candidate can exit the scheme anytime, the contribution will be refunded to the subscriber along with the net actual interest earned on his contributions. Any special circumstances such as death of the beneficiary can also be considered as the closure of the scheme and amount will be paid to nominee in this case.

PFRDA Recent Proposal to Revamp Atal Pension Yojana

PFRDA has sent a proposal to the central government which states the following things:-

- An Increase in the Pension Limit from Rs. 5000 per month to Rs. 10,000 per month. Till date, the pension limit is confined to 5 slabs starting from 1000 to 5000.

- Specific Procedure for Automatic Enrollment of Citizens in APY Scheme. Existing enrollment of subscribers in non-automatic.

- Increasing the maximum age limit under APY to 50 years. The existing maximum age bar under APY is 40 years whereas the minimum age bar still remains same i.e 18 years.

The central govt. is working on the proposal sent by PFRDA on Atal Pension Yojana to widen its base and attract more number of people in it.

Atal Pension Yojana Review

— For Atal Pension Yojana Scheme Details in pdf format – Click Here

— For any further query, aadhaar seeding issues, grievance redressal and other related issues, please visit the official website npscra.nsdl.co.in

from सरकारी योजना

via

0 टिप्पणियाँ