Central govt. has announced to reduce the House Building Advance Scheme 2021 interest rate on HBA interest rate from existing 8.5% to 6.64%. The Narendra Modi led central government had earlier revised the House Building Advance rules for Central Government Employees incorporating the accepted recommendations of the 7th Central Pay Commission or 7th CPC. The Union govt. has even revised the loan amount and some rules under the HBA Scheme. In this article, we will tell you about the complete details of the House Building Advance Scheme.

House Building Advance Scheme 2021 for Central Govt Employees

House Building Advance Scheme interest rate 2021 will be linked to the 10-year G-Sec yield on the amount of advance taken for building home. Currently, the rate of interest on Housing Building Advance is at 8.50% of simple interest. As on September 14, 2019, the 10-year G-Sec yield stands at 6.64 per cent. This means the interest rate under HBA will fall from existing 8.5% to around 6.64% for the Central government employees. However, actual modalities on effective HBA interest rate are yet to be seen.

Amount for Central Government Employee under HBA Scheme

The total amount that a central government employee can avail of under House Building Advance Scheme is up to his or her 34 month basic monthly salary or Rs 25 lakh or cost of the house or the amount as per the repaying ability of the employee, whichever is lower for new construction or purchase of new house or flat.

A central government employee to claim HBA for house expansion too. But, the HBA for house expansion is capped at Rs 10 lakh or 34 month basic monthly salary, or amount as per the repaying ability of the employee, whichever is lower.

House Building Advance Calculator

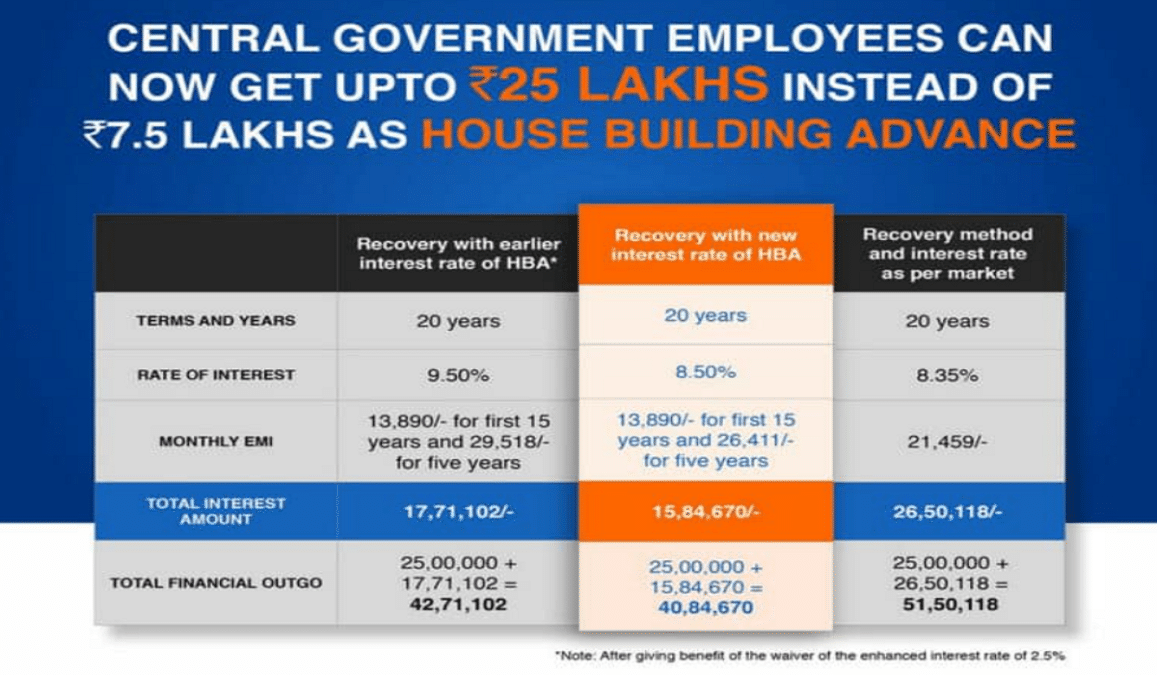

The methodology of recovery of HBA shall continue as per the existing pattern recovery of principal first in the first fifteen years in 180 monthly instalments and interest thereafter in next five years in 60 monthly instalments. If both spouses are central government employees, then both are eligible to claim HBA either separately or jointly.

Limit of Advance Loan Raised in House Building Advance Scheme

Earlier, the amount limit was Rs. 7.50 lakh with interest from 6 percent to 9.50 percent. Now the limit of advance loan has been raised under House Building Advance Scheme. As per the new limit, central govt. employees will be able to get advance loan up to Rs. 25 lakh at 8.5% interest rate.

Accordingly, the employee can take loan up to 25 lakh for the construction and purchase of a house at simple interest rate. This scheme is being implemented by the Housing and Urban Affairs Ministry. The benefits from this revised loan can be approx. 3 times as compared to the previous amount given under the House Building Advance Scheme.

However, the employees who are planning to repair / extend their houses can take loan up to Rs. 10 lakh compared to previous limit of Rs. 1.8 lakh. The interested candidates can apply for a loan by downloading the application form for this scheme.

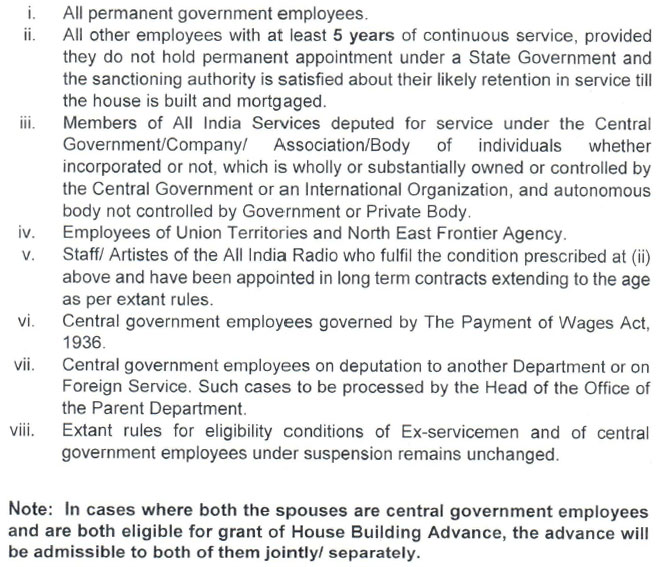

House Building Advance 2021 Eligibility Criteria

Below given the details of eligibility criteria for the scheme

As per the statement of Housing and Urban Affairs Ministry, the people will now be able to save much more by availing the benefit of the scheme as compared to borrowing from lending institutions on a loan of Rs. 25 lakh for the duration of 20 years.

Interest Rates Benefits Under HBA 2021

Benefits of House Building Advance 2021

Below given the details of revised rules of HBA 2021 as per the recommendations of the 7th Pay Commission.

- The employee can take the basic salary in advance of 34 months or up to Rs 25 lakhs. Previously, this limit was only Rs. 7.50 lakh.

- The beneficiary can use this money for the construction or purchase of a new house.

- The revised amount has been extended up to Rs. 10 lakh (earlier Rs 1.80 lakh) for expansion of house.

- The total cost of the home should not exceed 139 times the basic pay of of the employee subject to a maximum of Rs. 1 crore. However, this can be increased by maximum 25% on the basis of merit of individual case.

- The interest rate is now fixed at a nominal simple interest of 8.5% without any slabs. Previously, this interest rate was (6% to 9.5%) for loan of Rs 50,000 to 7,50,000.

- Now candidates can avail ‘No Objection Certificate’ at the time of HBA sanction.

- Moreover, the government also make easy provisions for the second charge and will ensure easy availability of the bank’s loan.

The interest rate under the house building advance 2021 scheme will be revised every three years in consultation with the Ministry of Finance.

House Building Advance 2021 Rules

Moreover, the candidate can download the PDF of new rules of House Building Advance 2021 from the official website of Ministry of Housing and Urban Affairs using the below link.

IN ENGLISH: House Building Advance Rules – https://dopt.gov.in/sites/default/files/Revised_AIS_Rule_Vol_I_Rule_23.pdf

House Building Advance Scheme Earlier Rules – http://mohua.gov.in/pdf/5a05336ac28f7HBA%20Rules%202017.pdf

For more updates and latest information about Housing Building 2021, please visit the official website at moud.gov.in.

from सरकारी योजना

via

0 टिप्पणियाँ