Goa government has launched Ashraya Adhar Scheme 2021 to provide financial assistance in the form of loan to the members of Scheduled Tribes. In Revised Goa Ashraya Adhar Scheme, govt. will provide house loan assistance for the purpose of repair, renovation / reconstruction of house as shelter is the necessity of every individual. Goa State Scheduled Tribes Finance and Development Corporation Limited will implement this Ashray Aadhar scheme.

What is Goa Ashraya Adhar Scheme 2021

The state govt. of Goa will help the Scheduled Tribe (ST) Community by providing financial assistance for Repair, renovation/

reconstruction of house. There are many members of ST Community who are willing to. But, due to higher rate of interest offered by bank, they cannot afford to avail the bank loan for repairs, renovation or reconstruction of house.

The objective of the Scheme “Ashraya Adhar Scheme” is to provide financial assistance in the form of loan for repair / renovation / reconstruction of house. Under this scheme upto Rs. 5,00,000 shall be advanced as financial assistance in the form of loan at 2% per annum.

Eligibility Criteria for Goa Ashraya Adhar Scheme

Any person belonging to Scheduled Tribe Community and having his house (which shall also include mundcarial house) either owned individually or jointly will be eligible for financial assistance under this scheme. In case the house is owned jointly and there are different units of the family in the same house residing separately, each such unit will be eligible for financial support under this scheme.

The age of the applicant should not be more than 55 years as on the date of loan application. However, the age of the applicant is relaxed up to 58 years in case the applicant is an employee of State/ Central Government/ Government Corporation/ Board or aided Institute.

Application Procedure

- The applicants need to fill up the prescribed loan application form complete in all respect along with 02 (Two) passport size photographs.

- The prescribed loan application form shall only be accepted with all the required documents under the Scheme after proper scrutiny. Thereafter the list of eligible applicants will be prepared and physical verification / inspection will be carried out by the officer of the Corporation. The application form along with documents and inspection report will be placed before the sanctioning authority as specified below for appraisal and approval.

Mode of Advance

The loan amount shall be advanced in two installments after submission of required documents complete in all respect.

- Rs. 3,75,000/- immediately after sanctioning the loan.

- Rs. 1,25,000/- on utilization of the first installment. Loanee shall commence the actual work within 03 months from the date of sanctioned amount released. The 2nd installment to be released on submission of utilization bills and on the basis of physical verification / inspection carried out by the officer of the Corporation.

Insurance

The beneficiary shall be insured for life and property with the Insurance Agency identified by the Corporation and premium of such policies shall be borne by loanee (unless and otherwise decided by the Corporation).

Repayment of Loan

- The loan shall be repaid in 120 equated monthly installments within a period of 10 years with a moratorium period of three months. However, if the applicant is above 50 years of age then the repayment period will be re fixed till the attainment of 60 years of age. In case the applicant is an employee of State/ Central Government/ Government Corporation/ Board or aided Institute then the loan repayment period will be re fixed till the attainment of his retirement age with additional six months from the date of retirement.

- The first installment of the repayment shall commence after the moratorium period of three months. Interest will be charged during the moratorium period. However if the loanee desiring to repay the loan immediately after the disbursement of 1st installment will be entitled to do so.

- In case of default in repayment of any installment an interest of 2% shall be charged on the overdue installment amount. No penal interest will be charged during the moratorium period.

- In case the beneficiary is desiring to borrow the loan from any other financial institution for reconstruction of his house during the loan repayment period advanced by the Corporation, the balance amount of the loan due to the Corporation shall be repaid in one lump sum and no due certificate will be issued to the beneficiary to avail loan from other institution.

- In case the loan is not repaid as per the scheduled of the scheme, the same shall be recovered as arrears under Goa Daman and Diu land Revenue code

Requirements

The applicant shall submit the following documents along with application form:-

- Scheduled Tribe Certificate (Self attested).

- Age proof of applicant (Birth Certificate / School Leaving Certificate / Driving License)(Self attested).

- Self Affidavit on Rs. 50/- Stamp Paper duly notarized.

- The copy of latest house tax receipt.(original/self attested).

- N.O.C from Co-owner (if any) on Rs. 50/- Stamp Paper duly notarized.

- Income Proof of the applicant i.e. salary certificate/ Last 03 months Pay slips along with Form 16 or last 06 months Bank Statement. Incase applicant is self employed then Last 3 years I.T.R. along with last 06 months bank statement or income declaration cum affidavit on `50/- stamp paper duly notarized to be produced.

- 02(Two) sureties with one passport photo of each surety, latest salary certificate or last three (03) months payslips along with last (06) months bank statement or Form 16 , affidavit of surety on Rs. 50/- Stamp Paper duly notarized and ID proof of surety. In case the applicant produces one surety working in the Government Department/ Corporation/ Board/Aided Institute then 2nd Surety not required. In case of applicant is the employee of State/ Central Government/ Government Corporation/ Board or aided Institute no surety is required

- Estimated Cost of Repair/Renovation/Reconstruction of house (as per format)

- Photos of the house to be repaired/renovated/reconstructed.

- Aadhar Card copy applicant (Self attested)

- Two passport size photos of applicant.

- Bank Mandate Form

Sanctioning Authority

The Chairman of the Corporation along with any two of the Director’s shall approve the applications for loan under Ashraya Adhar Scheme and thereafter Managing Director of the Corporation shall sanction the loan.

Evaluation

The Scheme will be implemented by Goa State Scheduled Tribes Finance and Development Corporation Ltd for five years from the date of issue. If required, scheme may be suitably modified to meet the new challenges/ requirement so as to achieve the set objective.

Removal of Difficulties

The Board of Directors of Goa State Scheduled Tribes Finance and Development Corporation Ltd shall be empowered to remove any difficulties arising out of implementation of the Scheme.

Interpretation

Regarding any doubt, same will be referred to the Government.

Miscellanous

(a) If any information or documents furnished / submitted by the applicant to avail the benefits under the scheme is found to be incorrect / fraud the person will be liable for criminal breach of trust.

(b) The fund advanced under this scheme shall not be utilized for any other purpose except for the purpose of Renovation/ repair/re-construction of existing house.

Other Conditions

(a) On sanction, the beneficiary will be required to file an agreement in the prescribed form of the Corporation.

(b) The applicant should not violate any provision of the existing Rules / Regulation of the State.

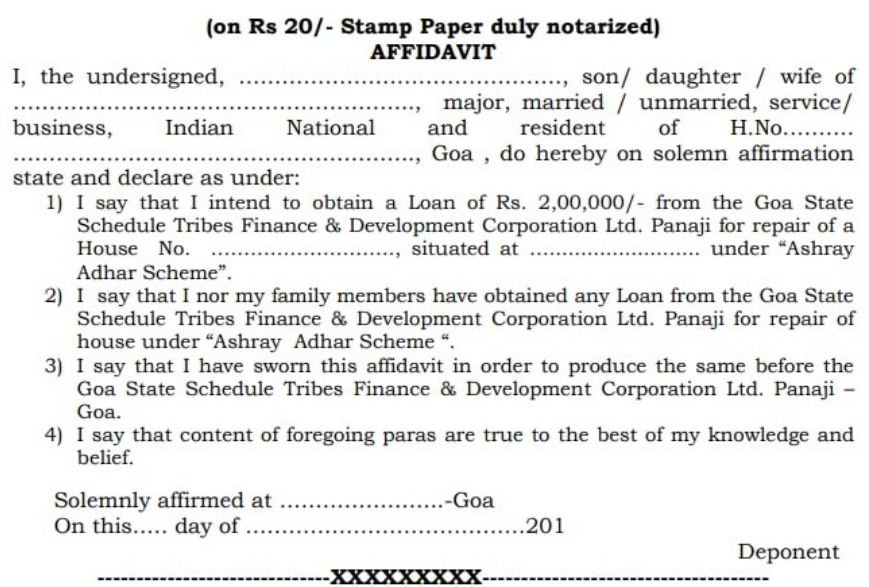

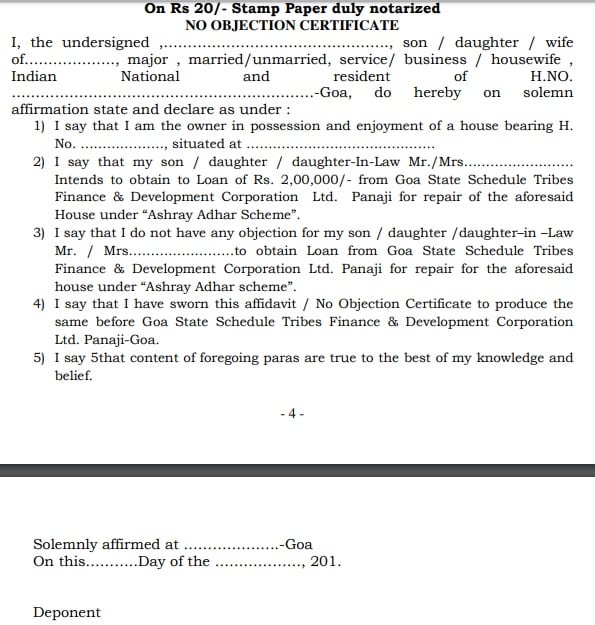

Revised Ashraya Aadhar Scheme Affidavit & No-Objection Certificate

Below is the direct link to download the Affidavit and No Objection Certificate:-

- The loan amount would be advanced in 2 phases – Rs. 3,75,000 immediately after sanctioning of loan and Rs. 1,25,000 on utilization of 1st installment certified by the valuer appointed by the corporation. Download link for Revised Ashraya Adhar Scheme Affidavit and NOC in Goa is given below:-

- https://www.goa.gov.in/wp-content/uploads/2016/05/Ashraya-Adhar-Scheme-Detail.pdf

- The affidavit is to be made on Rs. 20 Stamp Paper duly notarized in the format as shown below:-

- The format of No Objection Certificate which is to be made on a Rs. 20 stamp paper duly notarized in the format shown below:-

The net monthly income of the applicant must be in proportion of the EMI of the loan. The applicants will have to provide 2 guarantors who will guarantee loan payment in case the loanee fails to repay the loan amount.

Revised Goa Ashraya Adhar Scheme (2019 Update)

Now ST category applicants can download the format for affidavit and no objection certificate (NOC) to get assistance amount.

Goa Ashraya Adhar Scheme (Revised) for STs

Under revised Ashraya Aadhar Scheme, the amount of Rs. 5 lakh (previously Rs. 2 lakh) will be advanced in the form of loan at 2% interest rate per annum. The repayment period for assistance is 10 years which also includes moratorium period of 3 months to ST members. The age of the applicant must not exceed 55 years on the date of loan application. The age of applicant is relaxed upto 58 years in case of employee of state / central govt. / govt. corporation / board or aided institute.

For earlier update – https://www.goa.gov.in/wp-content/uploads/2019/07/Ashraya-Adhar-Scheme.pdf

For more details on updated Goa Ashraya Adhar Scheme latest version, click the link – https://www.goa.gov.in/wp-content/uploads/2020/11/ASHRAYA-ADHAR-SCHEME.pdf

from सरकारी योजना

via

0 टिप्पणियाँ