Gujarat Smart GST Software – GST Saheli Portal Registration 2021 and login at gstsaheli.co.in. This GST Saheli web portal enable auto generation of complex GST returns and other ad on services on the basis of easy invoice based data entry. It would provide GST related services to Micro, Small and Medium Enterprises (MSME), Industries, Sakhi Mandals, Cooperative groups and PSU’s through GST Sahayaks & Suvidha Kendras. Interested candidates can make online registration for invoicing, return filing at gstsaheli.co.in

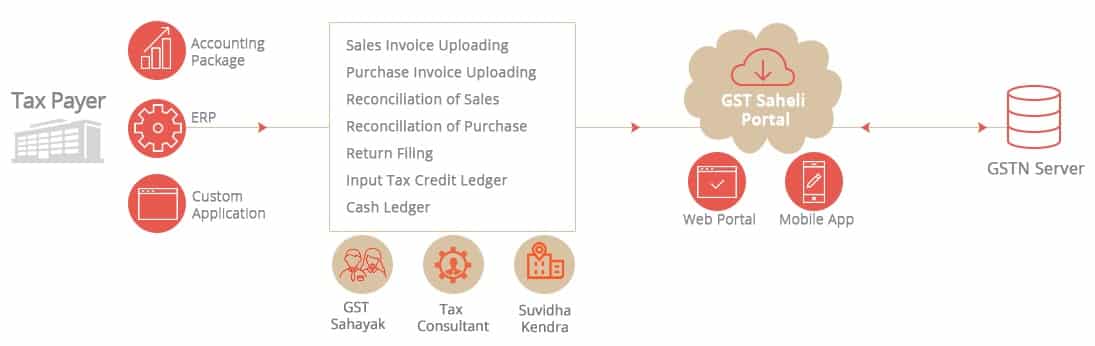

To make people understand the technicalities of GST in a much better way, Gujarat Livelihood Promotion Company (GLPC), which is a public sector undertaking owned by Gujarat govt. has started this web portal in Gujarati / Hindi / English language. You can now prepare and easily file GSTR-3B, GSTR-1, GSTR-2 and GSTR-3 returns, raise invoices, upload to portal, automatically identify data mismatches, avoid handling JSON files, and import data to excel right from the software.

GST Saheli is an integrated GSP-ASP solution approved by Goods and Services Network (GSTN). This portal will provide GST Saheli will be a giant leap towards the women empowerment and self employment of youths.

GST Saheli Online Registration (Return Filing)

This initiative will also help in financial inclusion of women and youths under GST – One Nation One Tax System. The important features of GST Saheli comprises of Invoicing, Return Filing, Comprehensive Dashboard for ITC ledger and Challan Generation. The complete procedure to apply online has been specified below:-

STEP 1: Firstly visit the official website http://gstsaheli.co.in/

STEP 2: On the homepage, click at the “Register” tab present in the header or directly click http://asp.gstsaheli.co.in/register.aspx

STEP 3: a) User can register as per Business Type b) User can register just for training by choosing training option c) Registration other than training already has free basic training included.

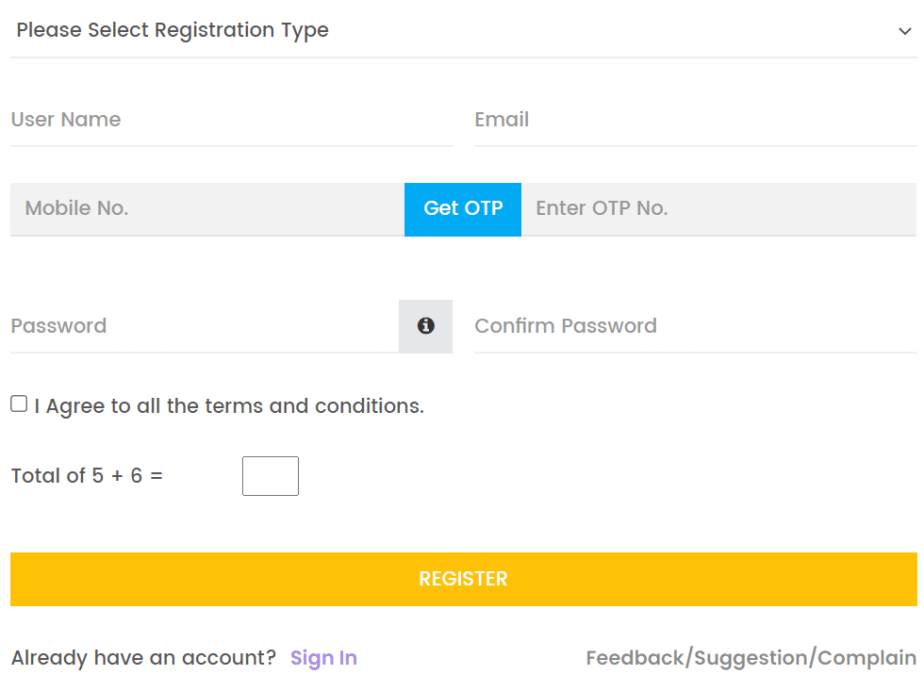

STEP 4: Afterwards, the “GST Saheli User Enrollment Form” will appear as follows:-

STEP 5: Here select registration type as ASP, CA / CS Expert, Tax payer, Tax Consultant, GST Sahayak, Micro and small consumers, medium business units, large corporates and business organizations, cooperative society, sakhimandal and training. Enter username, e-mail, mobile number, OTP, password and then click “Register” button at the bottom to complete the registration process.

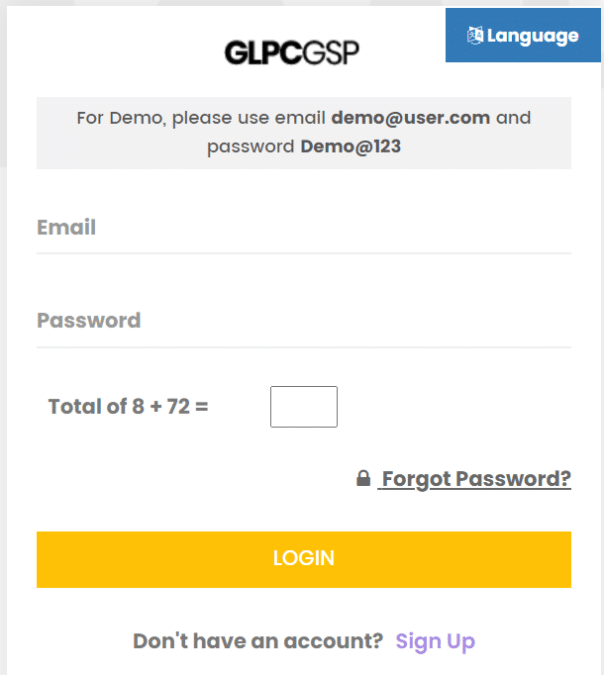

STEP 6: Finally after registration, candidates can make Login through the “Sign In” option or directly at GST Saheli Login link at http://asp.gstsaheli.co.in/login.aspx. The GST Saheli Portal Login page will appear as shown below:-

STEP 7: This will enable the users to access their own dashboard and to access GST related services as mentioned below.

This autonomous software is efficient and simplifies the entire process of return filing along with managing multiple clients. It includes CA / CS Experts, Tax Consultant / Sahayak, MSME and GST Suvidha Kendra.

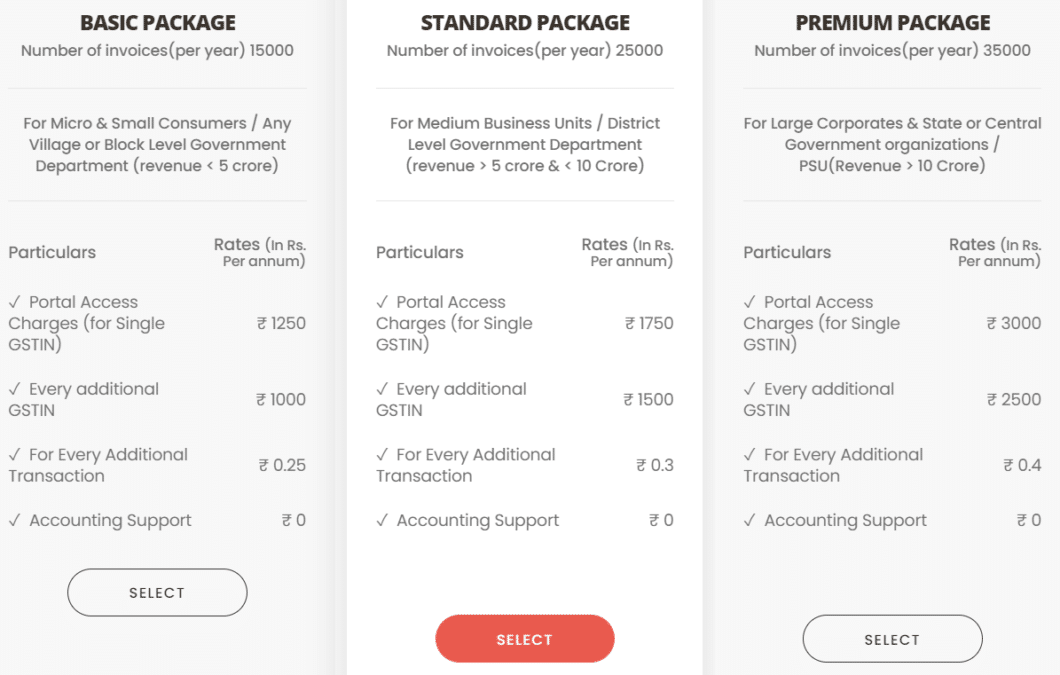

GST Related Services – Packages

All the GST related services will be given to Micro and Small Industries, Sakhi Mandals, Cooperative Groups with less than Rs. 5 crore turnover at minimal cost of Rs. 1250 per annum while for other Industries, the rate is Rs. 1750 per annum. Even all the Government Public Sector Undertakings can avail these services at Rs. 3000 per annum. For more details on the GST Services Packages, please click the link – http://gstsaheli.co.in/packages

People can now easily prepare and file GSTR-3B, GSTR-1, GSTR-2 and GSTR-3 returns, raise invoices, identify any data mismatch, avoid unnecessary handling of JSON files and even import data to excel format. Chief Minister has felicitated five GST Saheli Sahayaks and presented the certificates to them. Moreover, CM has also felicitated the first woman entrepreneur who paid tax through GST Saheli web portal.

Salient Features of GST Saheli Application Service

This integrated GSP-ASP solution unlocks new employment opportunities. People can manage multiple clients on one single dashboard with GST Saheli Software. This software supports multiple languages (Gujarati / Hindi / English) to maintain business effectively. The important features of the GSP Application are as follows:-

- Invoice based easy data entry

- Complex GST Returns are generated automatically & on real time basis. Therefore at any point of time, GST returns are ready to be filed

- In addition to English, services available in Gujarati and Hindi

- Virtual GST Service Provider (GSP) platform registered with GSTN

- Commerce and accounting graduates skilled as GST Sahayak to provide services at a lower fees for MSMEs & Co-operatives

- Further relief for MSMEs and cooperatives in annual fees for GST Saheli

- Along with GST Returns, additional features like cash/credit register, client dashboard, invoice matching also provided

Purpose of GSP Application – GST Saheli Software

Simplify your GST filing process with an automated software solution

- Automate Goods and Service Tax Regime

- Support informal sector, cooperatives and especially MSME’s

- Generate Employment Opportunities for Youth

- Empower Clients with an integrated, affordable software

Goods and Service Tax Regime is a path breaking indirect Tax reforms that involves a huge transformation and change management especially of informal sector, MSMS’s, Co-operatives & Corporate houses which are mainly catered by GLPC in the Gujarat State.

This system will bridge the gap between GSTN and the taxpayers and is high on security and performance. GLPC aims to serve the underprivileged women and members of various vulnerable communities / groups in the entire state. This is done through organization and capacity building of groups to create sustainable livelihoods.

References

— In case of any query, candidates can submit their complaints though the link – http://gstsaheli.co.in/contactus

from सरकारी योजना

via

0 टिप्पणियाँ